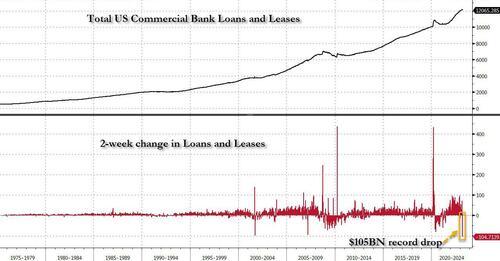

Those who peaked below the surface of the latest H.8 statement which, as discussed previously, saw the biggest drop on record in bank loans and leases in the last two weeks of March...

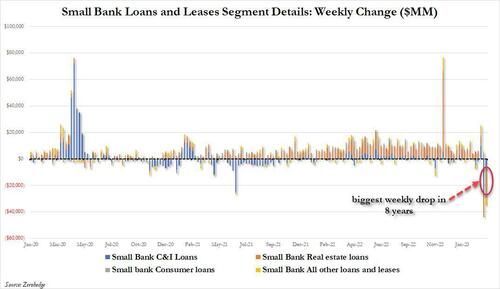

... found another, perhaps even bigger surprise. As we detailed over the weekend when breaking down the weekly change in small bank loans and leases by their core constituents, we found that whereas in the first week after the bank crisis (the one ending March 15) the bulk of the collapse in loans was in the traditionally volatile C&I space, the latest week was a surprise: that's because while the plunge in C&I loans moderated substantially to just $6.9BN from $25BN the week before, the biggest slide was in one of the anchor pillars of the small bank sector: real estate loans.

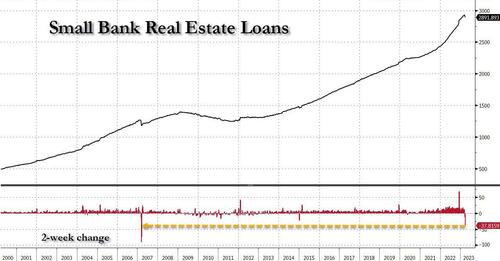

In fact, while the biggest drop among small bank loans in the latest week was the $18.7BN decline in real estate loans, this was a continuation of the $19.2BN drop in the previous week. Combining the two weeks reveals a $37.8BN plunge in real estate loans in the second half of March. This number is notable because it is the biggest since the collapse of the country's then 2nd largest subprime lender, New Century Financial in March 2007, which as most traders over 40 recall, was the catalyst that ushered in the global financial crisis, and within the year led to the collapse of Bear Stearns and, eventually, Lehman.

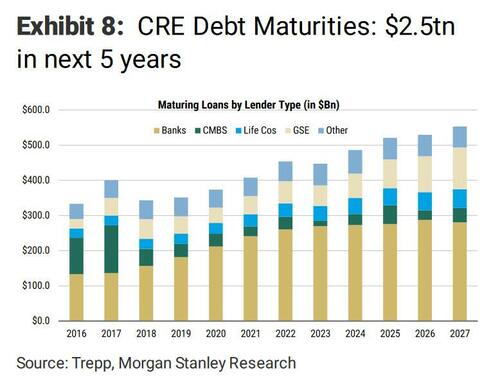

Of course, for the past month we have been warning that real estate and especially Commercial Real Estate is the ticking solvency time bomb within both large and small banks, now that the liquidity crisis that crushed several "small" banks has been contained courtesy of nearly half a trillion in reserve injections by the Fed. And while we previously discussed at length the coming multi-trillion CRE maturity wall, (see "New "Big Short" Hits Record Low As Focus Turns To $400 Billion CRE Debt Maturity Wall")...

... increasingly more are also seemingly starting to notice and, what is far more ominously, are taking a page out of the Margin Call playbook and quietly selling out of their real estate loan exposure: or to quote Kevin Spacey, "this is what the beginning of a firesale looks like."

To be sure, it's no longer just us that are focusing on the potential of CRE to be the next market crash catalyst. As Bloomberg wrote over the weekend, "almost $1.5 trillion of US commercial real estate debt comes due for repayment before the end of 2025. The big question facing those borrowers is who’s going to lend to them?"

Well, there is another even bigger question as the video clip above suggests, but we'll get back to it in a second.

Bloomberg quotes a recent must-read note by Morgan Stanley titled "Scaling Maturity Walls" (available to pro subs in the usual place) in which the bank's credit strategists write that “refinancing risks are front and center” for owners of properties from office buildings to stores and warehouses, adding that “the maturity wall here is front-loaded. So are the associated risks.”

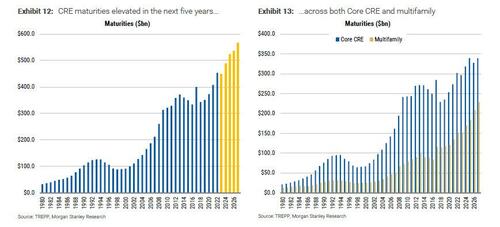

Looking at the charts below, Morgan Stanley's James Egan writes that "roughly $400-450bn worth of CRE loans are scheduled to mature in 2023. This is on par with 2022, and both of those years are the largest on record ( Exhibit 12 ). From there it doesn't get any easier, as maturities climb each year until 2027, reaching over $550bn." And "while the maturity walls within other asset classes might not be very front loaded, the issue within commercial real estate is happening right now."

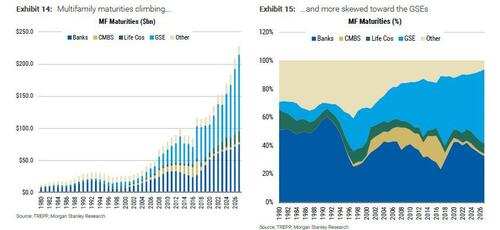

As these maturities come due, Egan warns that he is left many more questions than answers, "chief among them: who is going to be responsible for refinancing these loans as they mature? That story differs depending on property type. The multifamily space has grown very reliant on the GSEs over the years. From 2023 through 2027, 46% of maturities are currently guaranteed by the GSEs. As a reminder, in the GSE space, borrowers will ask lenders for a loan, and if the property meets the eligibility criteria for agency guarantee, then the lender should generally feel comfortable that the loan will be guaranteed by the agency when quoting a rate lock. The agencies will inspect the property at different times depending on the exact program, but given that the majority of agency guaranteed multifamily properties are held by borrowers with multiple properties, there is incentive to continue to work with the agencies."

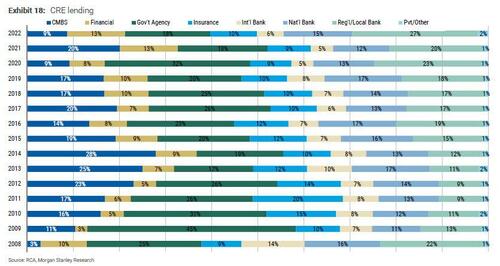

But the real punchline is that as these maturities are picking up, the single largest lender in the Commercial Real Estate landscape is the one that is now under the most scrutiny: regional banks, something we have been warning about for months. As Morgan Stanley notes in the next chart, in the years since the GFC, origination volumes and the share of that volume has varied, but since 2014 the trend has clearly been away from CMBS and toward regional banks.

Meanwhile, as we discussed previously, rising rates and worries about defaults have already hurt CMBS deals. Sales of the securities without government backing fell about 80% in the first quarter from a year earlier, according to Bloomberg calculations.

“The role that banks have played in this ecosystem, not only as lenders but also as buyers,” will compound the wave of refinancing coming due, the analysts wrote.

Unfortunately, when apartment blocks are excluded, the scale of the problems facing banks becomes even starker. As much as 70% of the other commercial real estate loans that mature over the next five years are held by banks, according to the Morgan Stanley report.

“Commercial real estate needs to re-price and alternative ways to refinance the debt are needed,” the analysts said.

To be sure it's not all doom and gloom, and as Bloomberg notes, there are some slivers of good news. Conservative lending standards in the wake of the financial crisis provide borrowers, and in turn their lenders, with some degree of protection from falling values. Additionally, sentiment toward multifamily housing also remains much more positive as rents continue to rise, one reason why Blackstone Real Estate Income Trust had a positive return in February even as rising numbers of investors lodge withdrawal requests. The availability of agency-backed loans will help owners of those properties when they need to refinance.

Alas, with regional banks now undergoing cardiac arrest, and unlikely to reboot their lending activity as long as deposit flight continues - which as discussed last week has slowed modestly but remains an existential risk to the regional banks and which is unlikely to be resolved as long as the Fed refuses to cut rates and remove depositors' preference from shifting funds from banks to safer, and higher yielding money markets (see "JPM Asks If The Fed Will Restrict Reverse Repo Use To Short Circuit $1.5 Trillion Bank Run")...

.... it doesn't take rocket science to realize that, just like in March 2007 when the collapse of New Century finally shocked everyone into a state of brutal realization that the party was over, it's about to get a whole lot worse.

How much worse? Well, according to Morgan Stanley office and retail property valuations could fall as much as 40% from peak to trough, creating a feedback loop of liquidations, bank failures, defaults and from there even more liquidations:

US securitized credit - CRE: $1.35-1.46 trillion (30-32%) of CRE debt matures by YE 2025 and banks hold ~42-56% of maturing debt. Recent attention on US CRE is understandable as the asset class faces a trifecta of risks:

- (1) Maturity walls are front loaded. Acknowledging the variance in the numbers reported by different sources, we estimate that nearly $566-615 billion (22-24%) of the outstanding $2.6 trillion core CRE debt (excluding multifamily) matures by year-end 2024 and another $275-340 billion (11-13%) is due in 2025.

- (2) Bank dependence is high - both as direct lenders to the asset and also as buyers of both agency and non-agency CMBS. Banks hold 36-64% of debt maturing each year and account for nearly half the agency CMBS and 10-15% of the non-agency CMBS investor base.

- (3) Valuation concerns have increased in specific sectors such as office and retail.

Our equity colleagues expect a 30-40% peak to trough correction in both asset classes.

We are glad that one month after we called CRE the "BIg Short 3.0", one of the largest and most respected US banks agrees. We are not glad that if, or rather when we are proven right that with trillions in loan maturities which nobody wants to roll CRE is about to become the next Subprime, the US financial system will suffer another existential shock, or as some call it "credit event."

Morgan Stanley's conclusion: “commercial real estate needs to re-price and alternative ways to refinance the debt are needed."

And while it may not have been Morgan Stanley's intention, yelling "re-pricing" in a burning theater can be even worse than yelling fire: it's the green light for everyone else to start selling... something the collapse in real estate loans suggest may have already started.

No comments:

Post a Comment