New Yorkers are weeks away from sweeping changes to their criminal justice system. A series of laws passed by the state legislature will take effect Jan. 1, 2020. The legislation concerns bail reform and new requirements related to the collection of evidence and the process of a speedy trial.

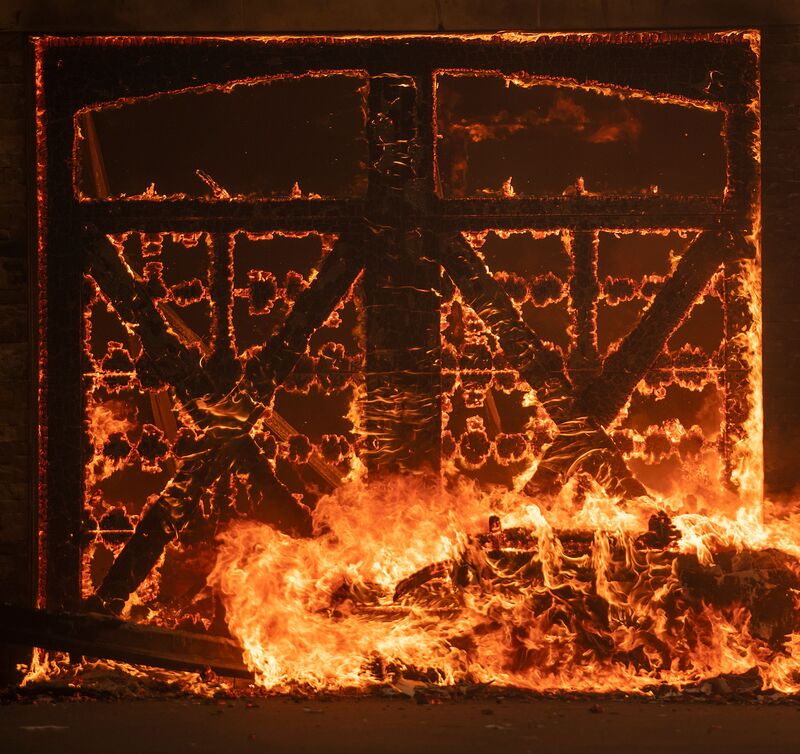

These laws will vastly and widely impact law enforcement and crime in New York, and not for the better. While well-intentioned, these measures will make New York City revert to the dire state of the 1970s, which some of us personally remember and some may associate with the 1979 film “The Warriors.”

From a public safety perspective, the new laws are a nightmare. Allowing criminals to be free and roaming the streets will only accelerate crime and send New York City back to the “bad old days” when lawlessness was rampant. I worked the streets as a detective when the city regularly saw thousands of homicides per year. In the 35 years since I’ve been retired, I am glad that crime has gone down significantly and the city has become one of the safest large cities on the planet. Politicians are making laws that can reverse decades of progress.

I certainly agree with the spirit of criminal justice reform and have personally supported bail reform. Thousands of people get entangled in the system, which can be unfair and cruel at points. For instance, a teenager with no prior record who gets arrested for a small amount of marijuana shouldn’t be sent to Rikers Island for months just because he can’t afford bail. However, these reforms will have severe unintended consequences that politicians are too short-sighted to think through properly.

The kind of bail reform presented here will put serious offenders on the street while awaiting trial. Bail will be eliminated all misdemeanors, most nonviolent felonies, including Class A drug felonies and even certain burglary and robbery charges. Even some homicide charges can have bail waived under these changes.

The NYPD will be forced to issue Desk Appearance Tickets (DAT) to people they arrest for all misdemeanors and many felonies, essentially crippling all enforcement. Under the new rules, it’s entirely possible for a person to be arrested for a robbery, get it downgraded to grand larceny and released without bail, then later in the same day commit another grand larceny, get another DAT, and be out in time to commit more crimes before supper. It may sound ridiculous but under these new farcical regulations, it could really happen.

Even more alarming are the potential effects of the new discovery requirements. Witnesses and crime victims’ names and home addresses will be released to defendants as soon as possible, within 15 days. Police and prosecutors already have a difficult job convincing witnesses and victims to come forward, under the new paradigm the task will be nearly Sisyphean. Detectives will now have to warn witnesses and victims that, their attackers may be on the street and have their name and contact information while awaiting trial. Undoubtedly this will discourage already scared and traumatized individuals from cooperating with investigations.

The current anti-police climate in the city has already contributed to lowering the morale among members of the NYPD. I speak to cops every day, and many of them tell me they are hesitant to act in the line of duty because they know city politicians and the top brass that reports to them won’t have their back in the event of a complaint. Police have always been ready to risk their lives for service, but now they risk their reputation and livelihood just by doing their jobs.

The discovery changes will require police to turn over evidence such as security camera and body camera to the defense within 15 days. The process of securing chain of custody of evidence can be time and labor intensive. These laws ignore NYPD budget and time restraints, and will drain existing resources, reducing the availability of detectives to carry out their core functions of investigating crimes.

These regulations can also hamper long-term investigations. If a suspect in a criminal enterprise (such as a gang member) is arrested and quickly released along with the names of all witnesses and victims, his or her accomplices and associates will have a heads up on investigations. They will be better able to elude prosecution and continue their criminal activity.

Especially unsettling is that grand jury testimony, which has for hundreds of years been kept secret in order to protect victims and help build cases, will now be disclosed to defendants and within 15 days. Keeping grand jury testimony secret has been effective for decades at securing witness cooperation and assuaging victims’ fears. Revealing grand jury information may also put jurors at risk of jury tampering and encourage someone facing indictment to flee and become a fugitive.

These new laws were passed for entirely political purposes and without regard for the safety of our city’s population. They were crafted without proper input or consultation by the police department and prosecutors. Such drastic changes will radically alter the criminal justice system on every level and create far-reaching consequences. The city is entirely unprepared for these imminent changes, which is a very scary thought. I hope the governor reconsiders these actions.