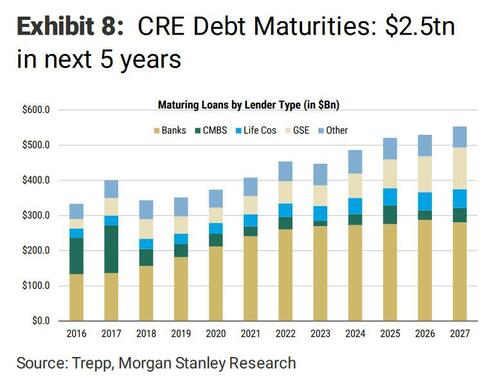

With recent stress in the regional banking sector, sentiment in US commercial real estate (CRE) - and especially the office sector - has turned negative as investors prepare for potential spillover effects (with JPM, Morgan Stanley, and Goldman Sachs all joining the gloom parade), especially as high-profile defaults continue to make headlines as borrowers face higher debt service costs and refinancing becomes much harder ahead of a $400 billion CRE debt maturities this year alone.

The latest headline fueling concerns about a potential CRE crisis involves a fund belonging to CRE giant Brookfield defaulting on a $161.4 million mortgage for twelve office buildings in Washington, DC.

According to Bloomberg, the loan was transferred to a special servicer working with "the borrower to execute a pre-negotiation agreement and to determine the path forward."

Real estate data firm Green Street said DC office space values had slid 36% through March compared with a year ago due to rising vacancies amid the rise of remote and hybrid work post-Covid.

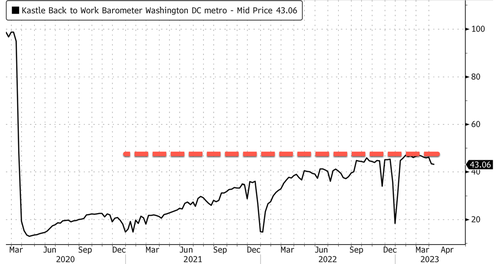

The gold-standard measure of office occupancy trends is still the card-swipe data provided by Kastle Systems. The average office occupancy across Washington, DC, is only 43% and has yet to recover to pre-pandemic levels.

Brookfield has also defaulted on debt tied to two Los Angeles buildings, the Gas Company Tower and the 777 Tower.

A spokesperson from the company blamed the pandemic for its CRE challenges.

"While the pandemic has posed challenges to traditional office in some parts of the US market, this represents a very small percentage of our portfolio."

Brookfield could potentially be the first in a series of companies defaulting on their office space loans. We've pointed out that the state of the CRE market is in dire shape as delinquency rates across property types, particularly offices, are rising. The lending environment is getting tougher ahead of $400 billion in CRE debt maturities this year.

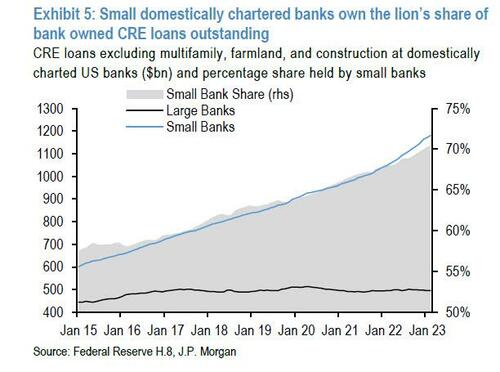

Meanwhile, the collapse of Silicon Valley Bank (and other regional banks) has put a magnifying glass on regional banks, and their CRE loan books remain a significant concern. As shown below, JPM's data as of February 2023, regional banks account for a staggering 70% of total CRE loans outstanding, excluding multifamily, farmland, and construction loans.

This will cause an acute credit crunch in secondary/tertiary CRE markets.

And then there's Bank of America's Michael Hartnett, who recently said, "You know what commercial real estate is, it's a boa constrictor tightly wrapped around the economy, suffocating growth for the next 2 years."

Bloomberg pointed out about a "dozen buildings in the Brookfield portfolio, occupancy rates averaged 52% in 2022, down from 79% in 2018 when the debt was underwritten."

The onset of a CRE crisis in the office sector will likely spark significant issues for regional banks and the Fed.

Apollo chief economist Torsten Slok recently noted:

In other words, with the commercial real estate bubble bursting, we are likely to enter three years with low growth, similar to what we saw after the housing bubble burst in 2008. Put differently, once the Fed starts cutting rates later this year, interest rates will likely stay low for several years, and QE is likely to come back in 2024.

Will Brookfield be the first of many to default on office building loans this year?

https://www.zerohedge.com/markets/dominos-falling-brookfield-defaults-161-debt-dc-office-buildings

No comments:

Post a Comment