Courtesy of the Federal Reserve's most aggressive interest rate hiking cycle in a generation, a surge in remote work in a post-Covid world, and imploding Democrat-run cities with radical progressives in City Halls who fail to enforce common sense 'law and order,' the office sector is reeling and faces an accelerated downturn.

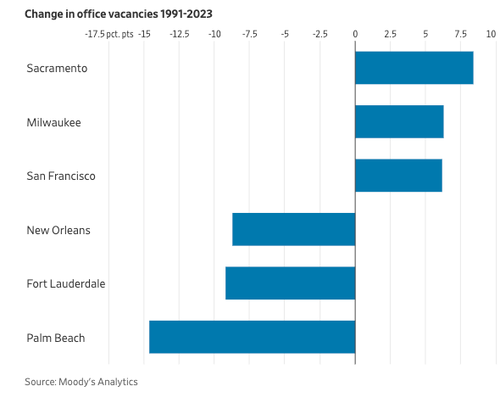

New data from Moody's Analytics shows that 19.6% of office space across major US metro areas was not leased as of the fourth quarter of 2023, exceeding the previous high of 19.3% in the commercial real estate downturn between 1986 and 1991.

"The bulk of the vacant space are buildings that were built in the 1950s, '60s, '70s, and '80s," Mary Ann Tighe, chief executive of the New York tri-state region at real-estate brokerage CBRE, told The Wall Street Journal.

The new record directly reflects the remote and hybrid work trends that have surged since Covid as companies reduce overall corporate footprints.

Kastle Systems, the gold-standard measure of office-occupancy trends via card-swipe data, has yet to recover from pre-Covid levels.

Another driver of rising office vacancy, but not mentioned in the WSJ report nor other legacy corporate media outlets covering the new Moody's Analytics data, is that failed social justice reforms in Democrat cities have forced companies to shift operations to safer areas. This is a topic widely ignored by woke journos.

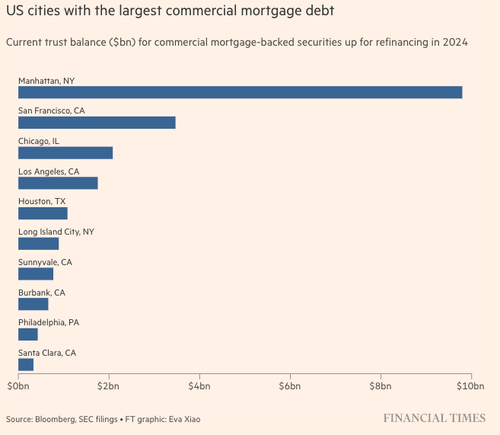

In a previous report, the Mortgage Bankers Association found that $117 billion in CRE office debt needs to be repaid or refinanced this year. This debt is concentrated in Democrat cities like New York City (Manhattan), San Francisco, Chicago, and Los Angeles.

Unless the Fed aggressively begins cutting rates in March, building owners' ability to obtain financing for previous loans will have trouble rolling over that debt.

This will only mean regional banks with high exposure to the CRE space could face a tsunami of credit losses over delinquent CRE loans

https://www.zerohedge.com/markets/office-vacancies-hit-record-across-us-cities-cre-downturn-worsens

No comments:

Post a Comment