Insurance costs are soaring and companies are canceling policies and upping rates. Don’t blame climate change. I address the real reasons for this mess.

Dropped

I had been working on this insurance idea for a few days. The Tweet by Adam drives the message, but only for fire insurance. I added hurricane and river flooding.

There are other flood zones along any major river or low areas. Hurricanes also cause flooding. People need wind and flood insurance in some zones. Judging from the map, some places in Florida are at risk for several reasons.

The link in the above Tweet is paywalled.

Buying Home and Auto Insurance Is Becoming Impossible

The Wall Street Journal reports Buying Home and Auto Insurance Is Becoming Impossible

After Allstate suffered billions of dollars in losses and failed to get the rate increases it wanted, it resorted to the nuclear option.

The insurance giant threatened last fall to stop renewing auto insurance for customers in three states that hadn’t given in to its demands, which would have left those policyholders scrambling for coverage. The states blinked.

In December, New Jersey approved auto rate increases for Allstate averaging 17%, and New York, a 15% hike. Regulators in California are allowing Allstate to boost auto rates by 30%, but still haven’t decided on its request for a 40% increase in home-insurance rates after the insurer refused to write new policies.

Farmers Insurance Group increased home-insurance rates by more than 23% last year for tens of thousands of policyholders in both Illinois and Texas, according to S&P Global Market Intelligence. Nationwide Mutual said it won’t renew 10,525 home-insurance policies in hurricane-prone areas of North Carolina.

State Farm racked up $13 billion in property-casualty underwriting losses in 2022, its worst ever. Last year, it stopped writing new home-insurance policies in California. The state’s regulators last month approved a 20% home-insurance rate increase.

In California’s wildfire-prone San Bernardino County, insurers in 2021 refused to renew 1,355 policies in a zip code that abuts Lake Arrowhead, north of San Bernardino, up sharply from 157 refusals in 2015, according to an analysis by research firm First Street Foundation.

In November, Chaucer Group, a London-based reinsurer, named several regions once considered low risk for wildfires that it said are “quickly becoming areas of concern for catastrophic wildfire insurance losses.” They include mountainous areas between Salt Lake City and Denver, and the Appalachian Mountains from Tennessee to New York.

Another concern is Texas, partly because of increased development on the fringes of metropolitan areas stemming from migration from California, the report said.

Despite some concessions from regulators, insurers are bracing for a tough future. Allstate’s Wilson said that everywhere in the country is at some risk from increasingly severe weather. “There is no place that’s safe,” he said, “and no place that’s not going to be impacted.”

Reinsurers to the Rescue?

Also consider the WSJ report The Insurance Market Is Healing

Going into last year, rising interest rates helped lead to a slower influx of capital into reinsurance, which is the backstop that insurers use to protect against so-called tail risks such as hurricanes and earthquakes. That finally gave the upper hand to reinsurers in pricing negotiations, after several years of seeing their pricing struggle to keep up with the rising losses on global catastrophes. That in turn led primary insurers that sell coverage to individuals and businesses to bear more of their own risk.

Global reinsurers posted a return on equity of 21% on average in the first nine months of 2023, up 18 percentage points from the prior year, according to Fitch Ratings. Meanwhile, primary carriers have cited higher reinsurance costs for decisions such as halting sales of new homeowners policies in places like California. Property-casualty insurers overall are projected to have seen a drop in underwriting performance and returns in 2023, according to Fitch.

Is the Market Healing?

In Florida, the insurer of last resort is now the main provider of home coverage.

Perhaps one can make a claim “the market is healing” but customers facing 30 percent rate hikes likely will not see it that way.

Climate Change Nonsense

Politicians will be all over this story, but none of this has anything to do with climate change.

In nature, fire is a natural occurrence. Decades of fire suppression coupled with decades of accumulation of dead brush created these tinder boxes such that once big fires start, they are difficult to extinguish.

Please note blatant incompetence by PG&E, California’s electric utility.

PG&E equipment has repeatedly been linked to major wildfires, including the 2018 Camp Fire that killed 85 people. PG&E has faced several fines in relation to its connection with wildfires, including a $150 million settlement for the 2020 Zogg Fire. That fire burned 56,338 acres, or roughly 88 square miles.

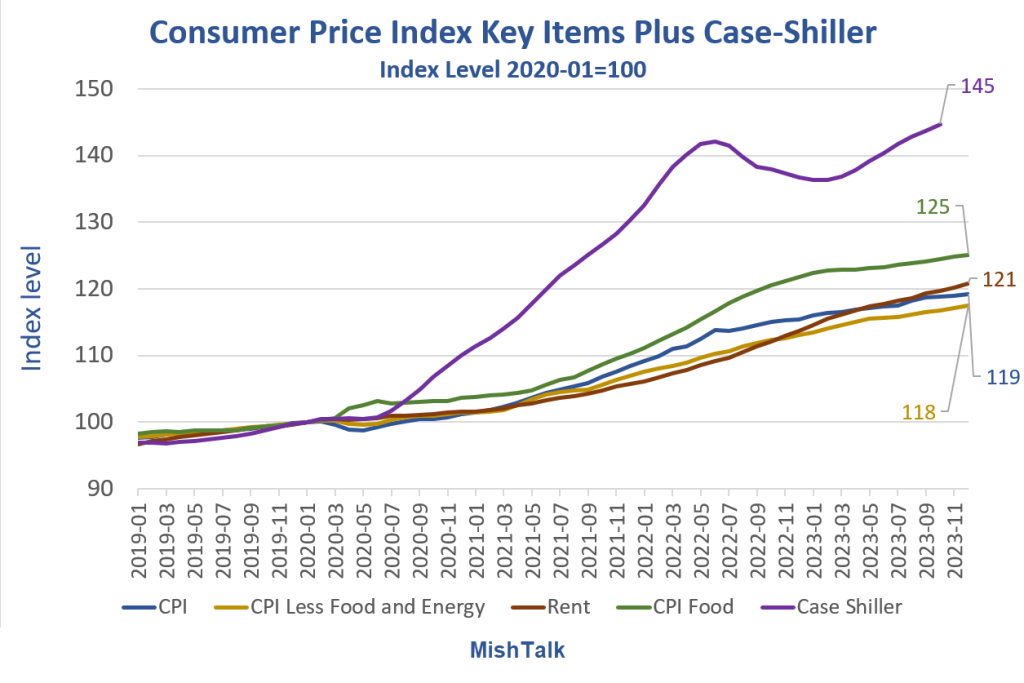

On top of PG&E and California regulatory incompetence, please factor in home prices

Consumer Price Index Items

Since 2020, home prices are up 45 percent. It’s safe to assume the price of labor fixing things after any kind of storm or fire damage is up even more.

Consumer Price Index Change Since January 2020 Key Items

- Home Prices (Through October): +45 Percent

- CPI: +19 Percent

- CPI Excluding Food and Energy: +18 Percent

- Rent of Primary Residence: +21 Percent

- Food: +25 Percent

Assessing the Insurance Fiasco Blame

- Inflation

- PG&E

- Failure to clear brush

- Building in flood and hurricane zone

- Climate change policy Itself (not failure to address climate change)

If insurance has doubled or tripled or cancelled, blame inflation, regulators in California and elsewhere for allowing homes to be built in flood zones and for not clearing brush in fire zones.

None of this has a damn thing to do climate change. It’s a combination of inflation coupled with poor policies, building in flood zones, and not clearing accumulated brush.

Is Inflation Down? That’s What President Biden Says

To highlight the discussion, I ask Is Inflation Down? That’s What President Biden Says

The irony is Biden’s climate change regulations coupled with his free money policies that are stoking inflation everywhere that’s to blame for this insurance mess, not climate change itself.

Nonetheless, have no fear, this insurance mess will all be blamed on “climate change”.

https://mishtalk.com/economics/canceled-are-you-at-risk-of-losing-your-home-insurance/

No comments:

Post a Comment