Global stock markets are rallying this morning on the heels of reports that China is working on a new basket of measures to support the property market after existing policies failed to sustain a rebound in the ailing sector.

Regulators are said to be considering reducing the down payment in some non-core neighborhoods of major cities, alongside lowering agent commissions on transactions, and further relaxing restrictions for residential purchases under the guidance of the State Council, according to sources.

China’s property sector has avoided a collapse but remains a key drag on the world’s second-largest economy.

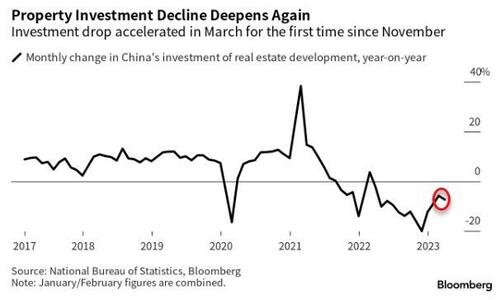

Signs of renewed weakness are emerging in the residential market, with a rebound in home sales slowing in May to just 6.7% from more than 29% in the previous two months.

“The sector is still sick,” Bloomberg Economics and Intelligence analysts including Chang Shu and Kristy Hung wrote in a May note.

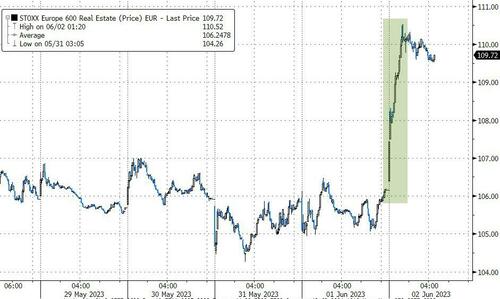

Having never met 'stimulus' measures they didn't like, Europe's real estate sector is leading the charge after the Hang Seng jumped over 4% and US futures are extending yesterday's melt up.

The Yuan rallied, copper, iron ore, and crude are up too.

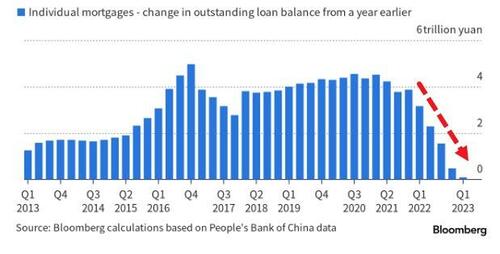

For some context of China's real estate problems, home-related new lending has plunged to its lowest since at least 2013...

The real estate industry’s downturn had been a major factor weighing on Chinese markets this year, weighing on both equity and credit markets.

The question, of course, is whether this latest bailout plan will be enough to rejuvenate the sector or are the Chinese simply too drenched in debt already?

Given the failure of the 'comprehensive 16-point plan' from November to reinvigorate, we have our doubts.

https://www.zerohedge.com/markets/china-property-bailout-rumors-send-global-markets-higher

No comments:

Post a Comment