Just days after China unexpectedly eased covid zero restrictions, sending commodities across the globe soaring amid hopes that China's covid crackdown may be finally ending, Bloomberg reported late on Saturday that Beijing has issued "sweeping relaxation measures on property and Covid controls", in what the media outlet called the strongest signal yet that President Xi Jinping is now turning his attention on rescuing the economy.

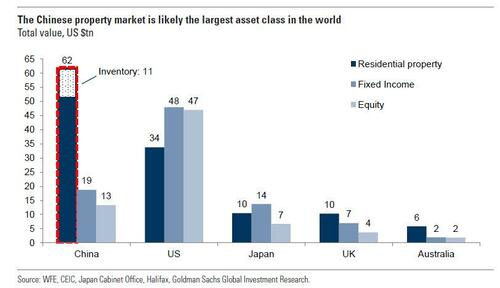

Confirming that China is increasingly concerned about its sinking economy, not to mention the local property market which Goldman last year calculated was the world's largest asset class...

Bloomberg reported that Beijing issued its most extensive 16-point rescue package for the struggling real estate market, citing "people familiar with the matter", marking a decisive effort to turn around an economy devastated by two years of Covid Zero curbs.

Specifically, the PBOC and the China Banking and Insurance Regulatory Commission on Friday jointly issued a notice to financial institutions laying out plans to ensure the “stable and healthy development” of the property sector. Unlike previous piecemeal steps which were purposefully vague, the notice included 16 measures that range from addressing the liquidity crisis faced by developers to loosening down-payment requirements for homebuyers.

As part of the rescue plan, developers’ outstanding bank loans and trust borrowings due within the next six months can be extended for a year, while repayment on their bonds can also be extended or swapped through negotiations, Bloomberg sources added.

The major policy shifts by Xi’s government, first on covid and now on property, will aid China’s growth outlook and add fuel to a market rally that sent a gauge of Chinese shares in Hong Kong up 17% in the past two weeks. It also ends a long period of policy paralysis before last month’s Communist Party congress when Xi jockeyed for a third term.

It’s also a stark reversal from the gloom that descended over markets in late October, after Xi’s elevation of close allies to the highest rungs of power stoked concern that ideology would trump pragmatism for the most powerful Chinese leader since Mao Zedong. The Hang Seng China Enterprises Index has now erased losses suffered in the immediate wake of the party congress, swinging from one of the world’s worst-performing stock gauges to among the best.

“It’s a meaningful easing,” said Larry Hu, head of China economics at Macquarie. “It seems that the room for policy change has widened on various fronts after the Party Congress, including for the two major headwinds to the Chinese economy: Covid Zero and property.”

As part of its attempt to kickstart the economy, on Friday Beijing also issued a set of measures to recalibrate their pandemic response, publicly outlining a 20-point playbook for officials aimed at reducing the economic and social impact of containing the virus, although as Bloomberg was quick to note, "the changes by no means signal the end of Covid Zero" and indeed, a day after releasing the new parameters, officials were quick to clarify that Covid rules were being refined, not relaxed, and a strict attitude toward stamping out infections remains China’s guiding principle.

The proposed changes take place just before Xi is set to meet US President Joe Biden Monday on the sidelines of a G-20 summit, in the first head-to-head meeting between the two heads of state since the pandemic began. Bloomberg adds that Treasury Secretary Janet Yellen will seek information on China’s Covid lockdown policies and the troubled property sector during a meeting with central bank Governor Yi Gang this week, according to senior Treasury Department officials.

Meanwhile, even with the rescue package, investors of Chinese property dollar bonds are still likely facing massive losses.

“The extreme pessimism in markets has finally led to a key policy change on the two biggest overhangs over the economy,” said Shen Meng, a director at Beijing-based investment bank Chanson & Co. “It’s still hard to say whether this is going to be a turning point for the economy though.”

Authorities have sought to defuse the property crisis with a raft of (largely toothless) measures in the past few months, including cutting interest rates, urging major banks to extend 1 trillion yuan ($140 billion) of financing in the final months of the year, and offering special loans through policy banks to ensure property projects are delivered. None of those measures, however, have made any material dent in China's rapidly slowing property market. Last week, China also expanded a key financing support program designed for private firms including real estate companies to about 250 billion yuan, a move that could help developers sell more bonds and ease their liquidity woes.

One of the biggest policy changes in the latest notice is to allow a “temporary” easing of restrictions on bank lending to developers. As a reminder, China began imposing caps on bank’s property lending in 2021, as authorities sought to tighten the reins on a bubble-prone industry and curb leverage at some of the nation’s largest developers. Banks not meeting the current restrictions will be given extra time to meet the requirement, said the people.

In addition, regulators encouraged lenders to negotiate with homebuyers on extending mortgage repayment, and emphasized that buyers’ credit scores will be protected. That may alleviate the risk of social unrest among homebuyers who have engaged in a widespread boycott on mortgage payments since July.

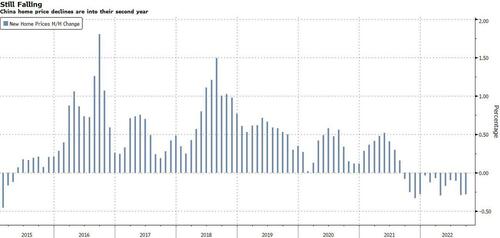

Meanwhile, China’s $2.4 trillion new-home market remains fragile and property debt defaults have surged, sparking increasingly concerns about social unrest. Price declines in the existing-home market were the most extreme in almost eight years in September, according to the latest official data. At banks, the proportion of bad loans related to property has surged to 30%, according to Citigroup estimates.

But while Chinese stocks have suffered depression-level declines in recent weeks, as a result of relentless home price declines, now in their second year...

... signs of easing property curbs and pandemic restrictions have led to a sharp rebound in China assets. A Bloomberg Intelligence gauge of Chinese developers’ stocks jumped a record 18% Friday, with Country Garden Holdings Co. surging 35%.

Still, Bloomberg cautions that the financial backstop is dwarfed by the looming debt maturities facing developers. China’s property sector has at least $292 billion of onshore and offshore borrowings coming due through the end of 2023. That includes $53.7 billion in borrowings this year, followed by $72.3 billion of maturities in the first quarter of next year.

So while Beijing's move is welcome, much more will be needed to convince markets that systemic risk has been mitigated: “China developers are facing another peak in debt maturity next year, if regulators don’t make adjustments for property-related policies, developer liquidity will continue to deteriorate,” said Shen. “This will very likely trigger systemic financial risk.”

No comments:

Post a Comment