by Artis Shepherd via The Mises Institute,

Recently, Freddie Mac, a government-sponsored enterprise, sought approval from its oversight agency, the Federal Housing Finance Agency (FHFA), to purchase and guarantee second mortgages in the United States.

While the business case for this proposal is deficient (for an excellent perspective on that, see the article by R. Christopher Whalen), I will discuss the economic and political premises behind this move and its possible consequences.

What Does It Mean to “Nationalize Second Mortgages”?

Understanding the single-family mortgage market in the US means realizing that there is no market in the real sense of that term. A whopping 70 percent of home mortgages in the US are owned or guaranteed by Freddie Mac and Fannie Mae, the two government-sponsored enterprises created by Congress to “support the housing market.” When the Federal Housing Administration and ancillary agencies are included, the proportion of mortgages supported by the government rises to approximately 95 percent. Naturally, this ubiquitous subsidy scheme supports a political goal—that of widespread home ownership—while making mortgages more accessible and homes much more expensive.

The government-sponsored enterprises are only nominally private—they were established by Congress specifically to “provide liquidity” to the home mortgage market by buying mortgages originated by banks and other institutions. They have always been subject to regulatory oversight by the government. This is especially true since their failure during the 2008 housing crisis, at which point they were placed into conservatorship under the FHFA.

Aside from mortgage loans, which are primarily used when acquiring a home, homeowners have additional ways to access the equity in their home. Banks and credit unions offer home equity lines of credit, home equity loans, and other second mortgage products to prospective borrowers. They’re “second” because, while secured by the underlying property, they are legally subordinate to the existing (“first”) mortgage. As such, second mortgages are riskier, are generally smaller in size, and incur a higher interest rate. Freddie Mac wants regulatory approval to hold these loans.

Freddie Mac, if approved, will almost certainly be followed by Fannie Mae. Thus, Freddie Mac’s proposal is an attempt to de facto nationalize the second mortgage market, in similar fashion to the existing first mortgage market.

There Will Be Blood

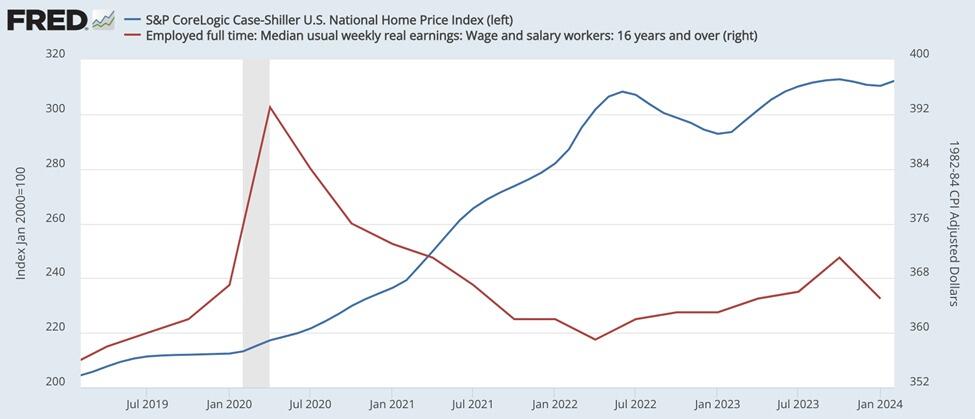

The Freddie Mac proposal should be seen in the context of an ongoing housing bubble combined with all-time highs in consumer debt. The Case-Shiller US National Home Price Index remains at all-time highs despite leveling off around the time benchmark interest rates increased in mid-2022.

Figure 1: Case-Shiller US National Home Price Index compared to the median weekly real earnings of those employed full time, 2019–24

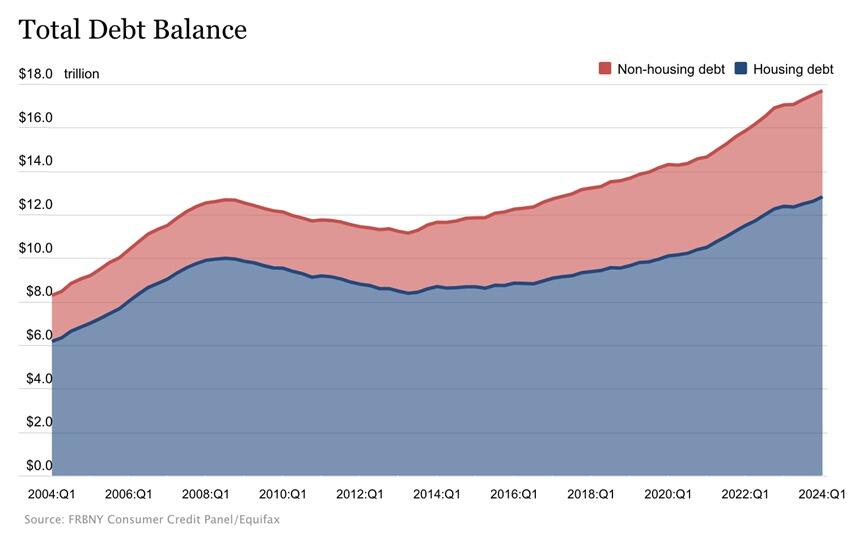

In the meantime, consumer debt continues to climb as price inflation persists and real wages are stuck.

The political imperative is clear—get more people to borrow against the equity that’s been created in the housing bubble of the last ten to fifteen years, especially the last four years. Doing so will likely boost gross domestic product figures as homeowners convert illiquid paper wealth into actual liquidity with which they will buy goods. Never mind that the debt created by this will pile on top of an already-unsustainable burden. This is especially true for the lower- and middle-income segments of the population, as 36 percent of US adults have more credit card debt than emergency savings.

Subverting the Free Market Again

If market participants wanted additional liquidity in second mortgages, they would create and price it accordingly. Shoehorning government participation will only guarantee malinvestment and significant collateral damage, exacerbating existing problems with asset inflation and household indebtedness. The will of individuals acting in their own interests is what creates a healthy market—not government decree from increasingly harebrained regimes desperate for shallow political points.

No comments:

Post a Comment