A combination of higher mortgage rates and sky-high housing prices has made it cheaper to rent than to own a home in all of America's largest metropolitan areas, according to a new report by Realtor.com.

The report, which tracks the top 50 metro areas in the US, found that while it was already cheaper to rent than buy in 90% of metros last year, it's now pushed to 100% - the first time this has happened since Realtor.com began tracking renting vs buying three years ago.

"With rents continuing to fall and the cost of buying a home remaining high" thanks to mortgage rates and home prices, "renting a home is now a more cost-effective option in all major U.S. markets," said Realtor.com chief economist, Danielle Hale.

To be sure, buying a house is a form of forced savings that builds wealth via an asset that appreciates over time. But the current market is too expensive for many Americans, given the steep rise in borrowing costs and home prices, relative to rents, in recent years.

For instance, the median rent in the New York–Newark–Jersey City metro area was $2,852, which was far cheaper than the $4,995 monthly cost of buying. -MarketWatch

The report calculates the monthly cost of buying a home by averaging the median listing prices of a studio, one-bedroom and two-bedroom homes in a tracked metro. It's then weighted by the number of listings in each market, and assumes buyers are putting down 8% on a home purchase (which then tacks on Private Mortgage Insurance (PMI) of course), with a mortgage rate of 6.78%.

As for that PMI which pushes costs higher - the nationwide average down payment on a home in America is 14.4% according to Forbes - still below the 20% threshold to eliminate PMI.

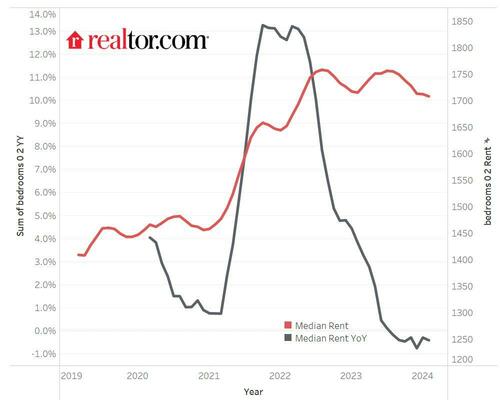

Rents, meanwhile, have declined - however they sit just 2.8% below the 2022 peak.

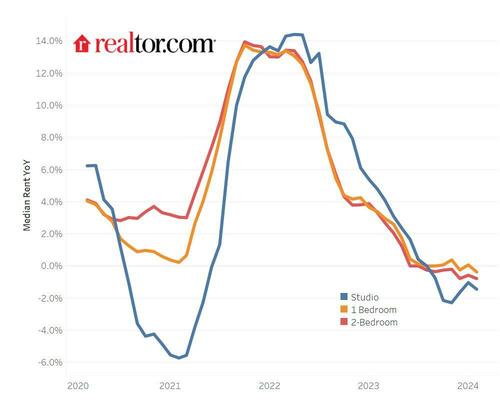

The declines were observed across the spectrum:

Highlights from the report (via Realtor.com):

- February 2024 marks the seventh year-over-year rent decline in a row for 0-2 bedroom properties observed since trend data began in 2020. Asking rents dipped by $7 or -0.4% year-over-year (Y/Y).

- The median asking rent in the 50 largest metros decreased to $1,708, down by $4 from last month and down $50 (-2.8%) from its August 2022 peak.

- Median rent was mixed across size categories: Studio: $1,426, down $21 (-1.5% ) year-over-year; 1-bed: $1,587, down $6 ( -0.4%) year-over-year; 2-bed: $1,889, down $15 (-0.8% ) year-over-year.

- In all of the 50 largest U.S. metros, renting a starter home is a more affordable option than buying one. In these markets, the monthly cost of buying a starter home in February 2024 was $1,027 more or 60.1% higher than the cost of renting.

- The overall advantage of renting became more pronounced. The monthly savings from renting were $162 higher compared to the prior year across the top 50 metros.

In December, the Wall Street Journal reported that homeownership "has become a pipe dream for more Americans, even those who could afford to buy just a few years ago."

It is now less affordable than any time in recent history to buy a home, and the math isn’t changing any time soon. Home prices aren’t expected to go back to prepandemic levels. The Federal Reserve, which started raising rates aggressively early last year to curb inflation, hasn’t shown much interest in cutting them. Mortgage rates slipped to about 7% last week, the lowest in several months, but they are still more than double what they were two years ago.

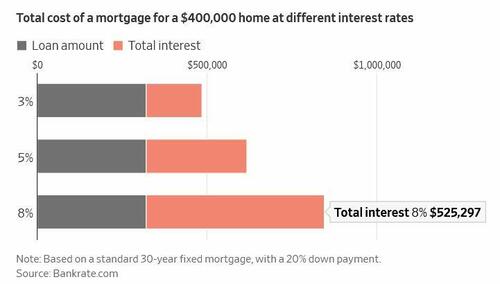

One can see the impact of high mortgage rates over the course of a loan. A few percentage points can mean hundreds of thousands of dollars more in interest spent over the life of a 30-year mortgage.

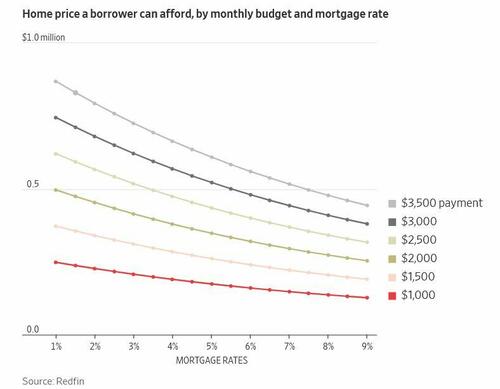

This boils down to a much lower average price that borrowers can afford.

As the report notes further, first-time and young buyers are 'still stuck on the sidelines' - with around 1/3 of buyers last year being first-time home buyers, below the historical average of 38%, according to the National Association of Realtors.

What's more, the median age of first-time buyers last year was 35-years-old, the second-highest on record after 2022's peak of 36.

https://www.zerohedge.com/personal-finance/renting-now-cheaper-owning-all-americas-largest-metros

No comments:

Post a Comment