It's an uncertain time for investors and financial markets. Since the last Two-Month Forecast, improving news on the inflation front faded, as prices have mostly stopped declining and may have even firmed up a bit. Meanwhile, the settling in the labor market became unsettling, with outsized job growth in both January and February signaling considerable resilience in hiring. Moreover, the number of open and unfilled positions remains very high and claims for unemployment benefits very low, and both despite a steady if slow drumbeat of high-profile layoff announcements.

Economic growth has been expected to stall for some time now, but the pick up in economic activity in the latter half of last year seems to be continuing. After quarterly annualized growth rates of 3.24% in the third quarter of 2022 and 2.68% in the fourth, the current reckoned running rate for GDP for the first quarter of 2023 is 3.2% per the Atlanta Fed's GDPNow model. While plenty of data is yet to be incorporated in to that model, we're closing in on the end of the first quarter of 2023, so about two-thirds of what will eventually be included is already factored into the estimate.

Both long- and short-term interest rates firmed throughout February and into early March as investors started to appear to believe the Fed's repeated message that rates would be moved higher and hold there for longer.

With inflation running too hot, labor markets still tight and growth powering along, Federal Reserve Chair Jay Powell seemed to set the stage for a larger-sized hike in the federal funds rate at the March meeting. His comments before Congress in semi-annual testimony about monetary policy in early March suggested as much, and investors quickly shifted to expectations not only for a larger near-term increase but also perhaps an additional quarter-point kicker down the road.

And then, several bank failures and concerns about spillover to others destabilized things.

Recap

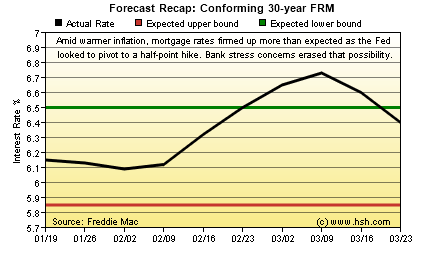

Our January Two-Month Forecast turned out to be mostly right. At that time, we expected mortgage rates to move up on the premise that rates "moved lower than current conditions warranted" and were due for a bounce back. We called for a range of rates for the conforming 30-year fixed-rate mortgage as published by Freddie Mac to run between 5.85% and 6.50%, and that expectation was met in six of the nine weeks of the forecast period. Three weeks landed above our range top, with a peak of 6.73% for the period.

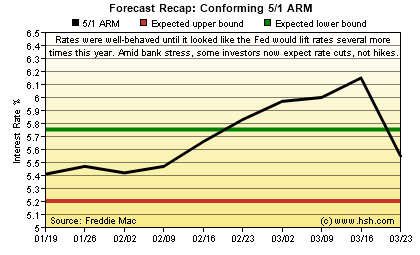

For hybrid 5-year ARMs, we ended up being a little less right, as only five of nine weeks feel between our bookends of 5.20% and 5.75%. With short-term rates bumping higher as expectations for Fed moves evolved, the initial fixed interest rate for the most popular ARM powered past the top of our forecast, peaking at 6.15% before dropping back sharply as policy expectations downshifted again.

We'll claim a partial victory for the forecast, which might've earned a B- in a standard letter grading system.

Forecast Discussion

Amid spreading concerns over the banking system, the Fed quickly created backstopping programs to ensure banks had access to sufficient funds to meet depositor demands. Importantly, it opened up a credit facility -- the Bank Term Funding Program -- that allowed banks to sell Treasury and MBS holdings at face value, so cash could be raised without the risk of loss. Until a couple of weeks ago, the Fed had been shrinking its balance sheet of bond holdings, but has now re-expanded it by about 400 billion dollars in the last few weeks.

While it's not clear yet if it has changed the path for future monetary policy, there is an expectation that nascent banking concerns will tighten credit conditions. At his post-FOMC press conference in March, Mr. Powell noted that "In principle as a matter of fact, you can think of [these tighter credit conditions] as being the equivalent of a rate hike or perhaps more than that, of course it's not possible to make that assessment today with any precision whatsoever."

Before the failure of SVB and Signature Banks, the Fed appeared on track for a half-point increase; with markets roiling, they opted for just a 25 basis point move. The updated Summary of Economic Projections from Fed members was for the most part little changed from January, with the federal funds rate still projected to have a peak of 5.1% this year but with a slower pace of rate reductions seen for 2024 overall. We'll not know until June is FOMC members' thinking about future policy has changed, but we'll also know better by then what's happening with the economy, labor markets, inflation and overall credit conditions.

At least for now, futures-markets speculators have done a 180 degree turn as it pertains to their expectations for monetary policy. At the beginning of March, a majority of bets pointed to a 50 basis point move by the Fed at the March meeting, and there were sizable percentages calling for quarter-point moves in May and perhaps June. After the failures of SVB and Signature (plus a market-engineered support of First Republic Bank and Credit Suisse folding into UBS), futures markets now seem to expect a less than 50% chance of a 25 basis point increase in the fed funds rate come May. Looking ahead until later in the year, there are increased probabilities of cuts in the federal funds rate, with some starting as early as July.

In all of this, it's important to keep in mind that mortgages and mortgage-backed securities aren't Treasurys. Large drops in Treasury yields during times of financial market stress may influence mortgage rates slightly lower, but mortgage rates are unlikely to move nearly as much. You may note that the February run-up in mortgage rates was only partially reversed during the emergence of issues at banks, and the more stable that situation becomes, the greater chance for rates to resume creeping higher.

Those that may be hoping to see the Fed start cutting rates before long should also remember that bets on Fed rate cuts are bets that the economic climate will be worsening -- or that inflation will have begun a sustained turn toward the 2% core level the Fed hopes to see. Given the fairly firm economic climate at the moment and stubborn price pressures, it seems unlikely (although not impossible) that a sudden downturn in either component will show in the near term.

Should it come, a poor economic climate may bring lower Treasury yields, but perhaps not so much lower rates for mortgages. A worsening economic climate -- slowing growth, increasing joblessness, declining home values -- actually increases the risks of buying and holding mortgages, since the chances of mortgage delinquency or default begin to rise. To be sure, the Fed still owns a huge chunk of the MBS market; even though it stopped buying new MBS a year ago, runoff from its balance sheet is only happening at a very measured pace and as of March 15, it still holds $2.608 trillion in mortgage bonds. Arguably, perhaps the biggest risk of delinquency, default or asset devaluation is to the Fed's holdings, but there of course would be risks to banks and other holders of MBS, too.

All this as a backdrop, what will become of interest rates and mortgage rates? Much hinges on whether or not the banking stresses turn out to be isolated (or at least limited) and can be contained and managed. Absent a worsening banking issue, inflation and tight labor markets will again become the driver of where rates go this spring.

Even if increased or spreading concerns about the stability of some banks should emerge, the reality still remains that if inflation doesn't cool, interest rates can't fall much in the near-term. Presently, it's not even clear if the Fed is done raising rates or may lift them a bit more yet, and the Fed's own expectations are still that at least one more increase remains a possibility before it pauses. Once the so-called "terminal rate" for federal funds is reached, that's when you'll start to see greater expectations that rate cuts are on the central bank's radar. Mr Powell did close his press conference with a reminder that "rate cuts are not in our base case" at least through the end of 2023.

Forecast

With the wildcard of more bank balance-sheet issues lurking in the shadows, it's even more of a challenge than usual to forecast where mortgage rates will go until the cusp of summer. There is a Fed meeting due in early May, and even if core PCE prices do settle measurably from present levels by then they will still be well above the Fed's target. Although there is the promise of lower shelter inputs later this year into core PCE inflation, core services outside of housing remains too warm, and the Fed remains "strongly committed to bringing inflation back down to our 2 percent goal."

While we hope that the banking situation settles, we of course cannot know for sure that it will. Conversely, its a fair bet that inflation will remain too hot over the forecast period, that a sharp economic downturn won't come and that labor markets will pretty remain tight. These things suggest to us relative firmness for mortgage rates over the coming nine week period, and we expect that the average offered rate for a conforming 30-year fixed-rate mortgage as reported by Freddie Mac will run between 6.14% and 6.77%. For the initial rate for a 5-year ARM, we think that a pair of 5.40% and 6.02% fences should contain the initial rate for the most popular alternative to a 30-year fixed-rate mortgage.

This forecast expires on May 26, 2023. It'll be just about Memorial Day, the unofficial start of summer. As you consider warm days, barbecues and baseball, why not drop back in and see if this forecast was a foul ball or a home run?

Between now and then, interim forecast updates and market commentary can be seen in our weekly MarketTrends newsletter.

No comments:

Post a Comment