One month ago, when looking at the CME's little known housing price futures, we noted that at least according to the market, housing has now bottomed. A lot has changed since then, and while the May 23 Housing Price Futures contract has continued to ascent confirming the market remains optimistic in a bottom...

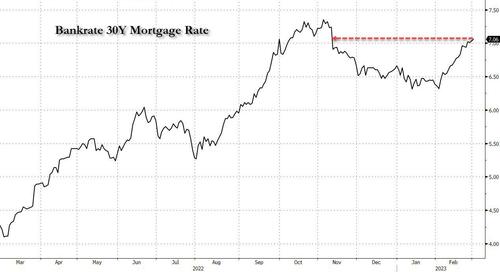

... the recent surge in mortgage may soon spoil the bullish outlook.

According to Bankrate, the average rate on the 30-year fixed mortgage jumped back over 7%, rising to 7.06% (7.10% according to Mortgage News Daily), the highest level since early November.

“Rates continue to move at the suggestion of economic data, and the data hasn’t been friendly. This is scary considering this week’s data is insignificant compared to several upcoming reports,” said Matthew Graham, chief operating officer at Mortgage News Daily.

When rates went over 7% last October - the highest level in more than 20 years - the housing market was being read its last rites, which was also one of the reasons why many expected the Fed to ease back on its tightening. But rates then pulled back in the following months, as inflation appeared to be easing. By mid-January rates were touching 6%, spurring a big jump in buyers signing contracts on existing homes.

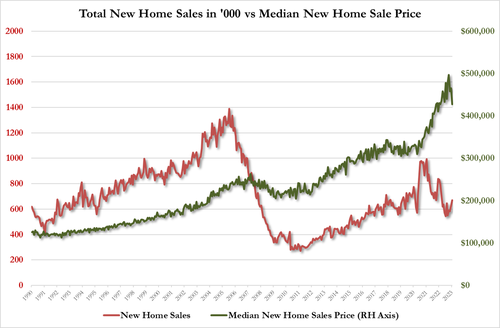

Since then, various housing indicators have shown a sizable improvement including new home sales , largely the result of a plunge in prices...

... as well as pending home sales which rose an unexpectedly strong 8% from December, according to the National Association of Realtors. But the past four weeks have been rough, with rates moving sharply some 100bps since the start of February.

That means that for a buyer purchasing a $400,000 home with 20% down on a 30-year fixed loan, the monthly payment, including principal and interest, is now roughly $230 a month more than it would have been a month ago. Compared with a year ago, when rates were in the 4% range, today’s monthly payment is about 50% higher, according to CNBC's Diana Olick.

As a result, mortgage applications from homebuyers have been falling for the past month and last week hit a 28-year low.

“The recent jump in mortgage rates has led to a retreat in purchase applications, with activity down for three straight weeks,” said Bob Broeksmit, president and CEO of the Mortgage Bankers Association. “After solid gains in purchase activity to begin 2023, higher rates, ongoing inflationary pressures, and economic volatility are giving some prospective homebuyers pause about entering the housing market.”

At the start of this year, with rates slightly lower, it appeared the housing market was starting to recover just in time for the traditionally busy spring season. But that recovery has now stalled, and rising rates are only part of the picture.

“Consumers have taken on a record amount of debt, including mortgage, personal, auto, and student loans,” noted George Ratiu, senior economist at Realtor.com. “With rising interest rates, financial burdens are expected to increase, making consumer choices more difficult in the months ahead.”

Which, of course, is just what the Biden admin and the Fed want.

No comments:

Post a Comment