The U.S. Department of Housing and Urban Development (HUD) funded $21.01 billion in multifamily loans during its 2022 fiscal year, which ran through last September. That's down sharply from the $29.48 billion it had funded during the previous fiscal year, its most-active year ever.

Multifamily Lending Volume

Meanwhile, during the last three months of 2022 (the first quarter of fiscal 2023 for the agency) it had originated 239 loans totaling $3.94 billion, putting it on track to originate $15.76 billion for the full fiscal year. This is an indication that the slowdown in lending has impacted every lender.

The agency funds its loans through a network of lender partners that during the 2022 fiscal year originated 1,077 loans against properties with a total of 159,707 apartment units. Those loans had an average balance of $19.51 million each, up from the $17.82 million average balance in the fiscal year.

Most Active HUD Lenders

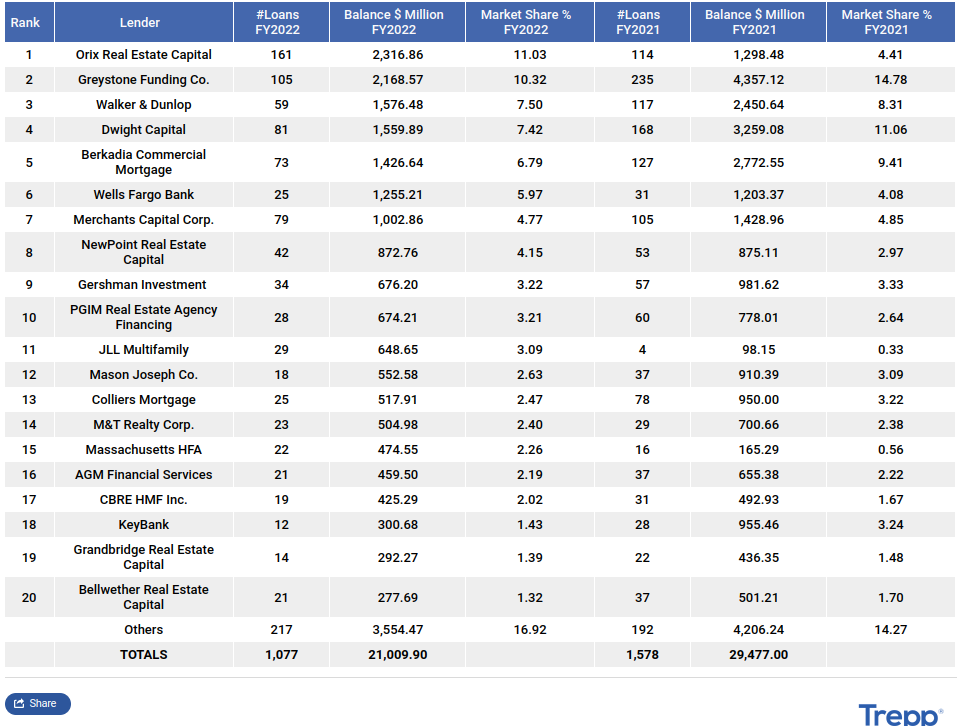

20 Most Active HUD Lenders (Initial Endorsements) FY2022

The agency's most-active lender partner was Orix Real Estate Capital, which originated 161 loans with a balance of $2.32 billion, or 11% of HUD's originations for the year. Behind it was Greystone Funding Co., with 105 loans totaling $2.17 billion, or 10.32% of the total volume. In total, 74 lenders originated loans under the agency's various programs.

A notable recent entry, NewPoint Real Estate Capital in the fiscal year 2022 originated 42 loans totaling $872.76 million. But that was because, in 2021, it had acquired Housing & Healthcare Finance of North Bethesda, Md., already among HUD's most active lenders of seniors housing loans.

How Does HUD Provide Financing?

Writing HUD loans is a highly specialized and time-consuming effort. It can take six months from when a loan application is completed until a loan closes. In addition, its loans carry insurance premiums. Those, however, are reduced for properties that are classified as being "green."

Patience has its rewards though. The agency can provide assumable financing for up to 85% of a property's value and 90% for those that rely on subsidies or are otherwise classified as affordable on a non-recourse basis. It also offers predictable prepayment fees that start at 10% and burn off after 10 years. Loans typically fully amortize over their lives.

The agency funds loans through a number of programs, the most popular during the last fiscal year was 223(f), through which it funds existing properties and has terms of up to 35 years. Roughly 60% of its originations were involved in the program. Its other programs are 221(d)(4), through which it provides construction/permanent loans that are used to fund the construction or substantial renovations of properties and can be had with terms of up to 40 years. There is also 223(a)(7) through which borrowers can refinance existing HUD loans in order to take advantage of lower rates. Those have an expedited underwriting process and closing can take as little as 60 days allowing borrowers to effectively extend their existing loan term.

A total of 53% of the units financed during the last fiscal year were classified as affordable, according to the agency. By dollar amount, 42% was against affordable properties.

No comments:

Post a Comment