From the Federal Reserve: The January 2023 Senior Loan Officer Opinion Survey on Bank Lending Practices

The January 2023 Senior Loan Officer Opinion Survey (SLOOS) on Bank Lending Practices addressed changes in the standards and terms on, and demand for, bank loans to businesses and households over the past three months, which generally correspond to the fourth quarter of 2022.

Regarding loans to businesses, survey respondents on balance reported tighter standards and weaker demand for commercial and industrial (C&I) loans to large, middle-market, and small firms over the fourth quarter.2 Meanwhile, banks reported tighter standards and weaker demand for all commercial real estate (CRE) loan categories.

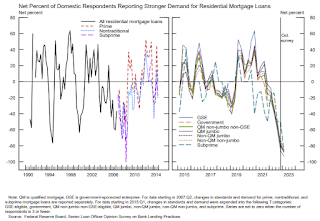

For loans to households, banks reported that lending standards tightened or remained basically unchanged across all categories of residential real estate (RRE) loans and demand for these loans weakened. In addition, banks reported tighter standards and weaker demand for home equity lines of credit (HELOCs). Standards tightened and demand weakened, on balance, for credit card, auto, and other consumer loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph on Residential Real Estate demand is from the Senior Loan Officer Survey Charts.

This shows that demand has declined sharply.

The left graph is 1990 to 2014. The right graph is 2015 to Q4 2022.

No comments:

Post a Comment