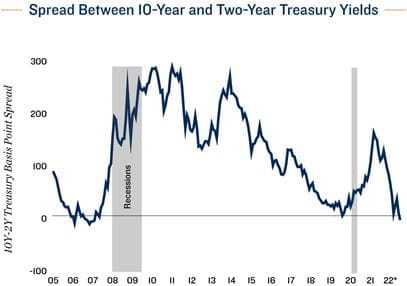

Possible recession predictor lit up this month. In early July, the spread between the two-year and 10-year treasuries inverted, with the yield on the shorter-term instrument inching above that of the long-term note. Typically, bonds with longer maturities pay a higher interest rate to compensate investors for the risk of holding those assets longer. When yields invert, it implies investors perceive more economic risk in the near future than down the line. Six of the past seven sustained inversions have preceded a recession by up to 23 months. As such, this most recent inversion has sparked concern for an impending economic downturn, especially as the Federal Reserve has been aggressively hiking interest rates to temper inflation. This assertive tightening, however, is distorting the treasury yields.

Inflationary climate inhibits inversion’s resonance. Rapid price increases have prompted the Federal Reserve to raise the federal funds rate by 150 basis points so far this year, with the central bank signaling another 75-basis-point hike for later this month. High inflation and the Fed’s response have added upward pressure to treasury rates, particularly for shorter terms. Longer-term rates are not climbing as quickly. The war in Ukraine has motivated more investors from around the globe to seek lower-risk U.S. government debt, such as the 10-year Treasury. This demand is keeping the Treasury note’s yield lower than it otherwise would be. Equity market volatility has also fostered a flight-to-quality toward bonds, which could lead to declining interest rates, at least temporarily. Given these factors, the current inversion between the 10- and two-year notes may be a false positive, as in 1998.

Inflationary climate inhibits inversion’s resonance. Rapid price increases have prompted the Federal Reserve to raise the federal funds rate by 150 basis points so far this year, with the central bank signaling another 75-basis-point hike for later this month. High inflation and the Fed’s response have added upward pressure to treasury rates, particularly for shorter terms. Longer-term rates are not climbing as quickly. The war in Ukraine has motivated more investors from around the globe to seek lower-risk U.S. government debt, such as the 10-year Treasury. This demand is keeping the Treasury note’s yield lower than it otherwise would be. Equity market volatility has also fostered a flight-to-quality toward bonds, which could lead to declining interest rates, at least temporarily. Given these factors, the current inversion between the 10- and two-year notes may be a false positive, as in 1998.

Other recession signals not present. Many economic indicators signal continued growth. The yield spread between the very short-term three-month Treasury and the 10-year note has not yet inverted, and is generally considered the more accurate predictor. Employers also continue to hire amid a steep labor shortage, with 372,000 jobs created in June, despite a historically low 3.6 percent unemployment rate. Household debt relative to income is also still low by historical standards. Although the nation’s GDP declined on an annualized basis in the first quarter, measures like these continue to support growth.

Commercial Real Estate Implications:

Higher interest rates add hurdles to property transactions. Commercial real estate investors are facing greater borrowing costs that are butting up against cap rates that have compressed over the past decade, reflecting perceptions of strong upside potential. Favorable property fundamentals continue to encourage sales activity, although investors are having to adjust expectations and strategies under the new rate environment. This may hinder the flow of transactions in the near term.

Vast majority of commercial real estate fundamentals in the green. Most property types continue to benefit from positive, structural demand dynamics. A persistent housing shortage sustains the need for multifamily housing, while elevated consumer spending relative to pre-pandemic is encouraging many retailers to resume expansion plans. Both leisure and business travel are on upward trajectories, aiding hotels, while an aging population supports the need for seniors housing and medical offices. Global supply chain disruptions have placed added emphasis on domestic warehouse, distribution and manufacturing spaces as well.

3.07% | 2.99% |

Market Yield on Two-Year Treasury on July 11, 2022 | Market Yield on 10-Year Treasury on July 11, 2022 |

* As of July 11

Sources: Marcus & Millichap Research Services; Bureau of Labor Statistics; CoStar Group, Inc.; Federal Reserve; U.S. Census Bureau

No comments:

Post a Comment