Higher Rents will impact measures of inflation in 2022

From ApartmentList.com: Apartment List National Rent Report

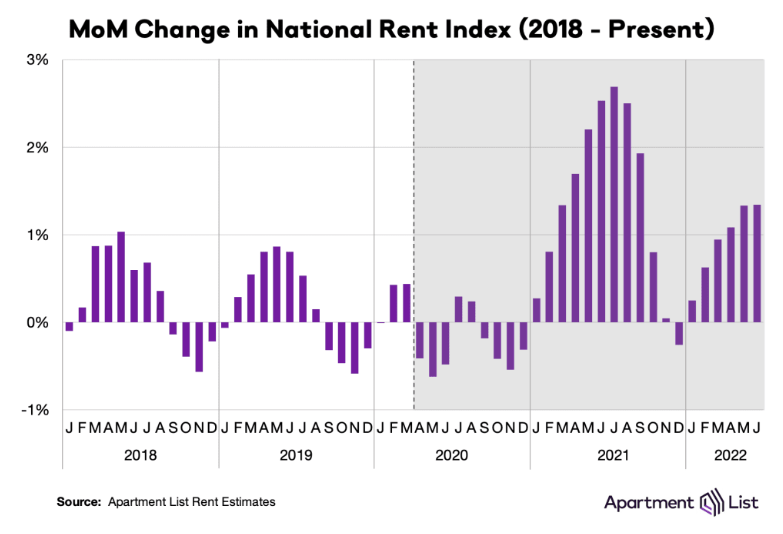

Welcome to the July 2022 Apartment List National Rent Report. Our national index rose by 1.3 percent over the course of June, consistent with last month’s increase. So far this year, rents are growing more slowly than they did in 2021, but faster than they did in the years immediately preceding the pandemic. Over the first half of 2022, rents have increased by a total of 5.4 percent, compared to an increase of 8.8 percent over the same months of 2021. Year-over-year rent growth currently stands at a staggering 14.1 percent, but has been trending down from a peak of 17.8 percent at the start of the year.

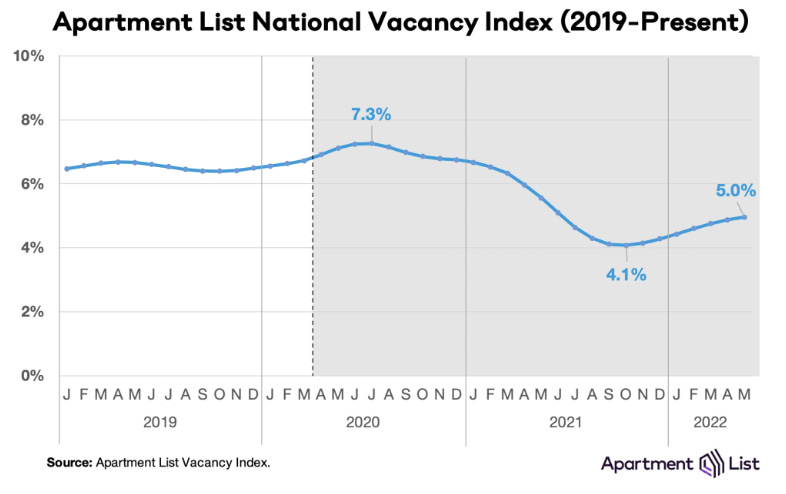

On the supply side, our national vacancy index ticked up slightly again this month, continuing a streak of gradual easing dating back to last fall. Our vacancy index now stands at 5 percent, up from a low of 4.1 percent, but remains well below the pre-pandemic norm. And with spiking mortgage rates sidelining potential homebuyers, we could see additional tightness in the rental market in the months ahead. Rents increased this month in 97 of the nation’s 100 largest cities. New York City has seen the nation’s fastest city-level rent growth over the past year, while some of the hottest Sun Belt markets are finally showing signs of plateauing growth.

emphasis added

Rents are still increasing sharply, but not as rapidly as a year ago.

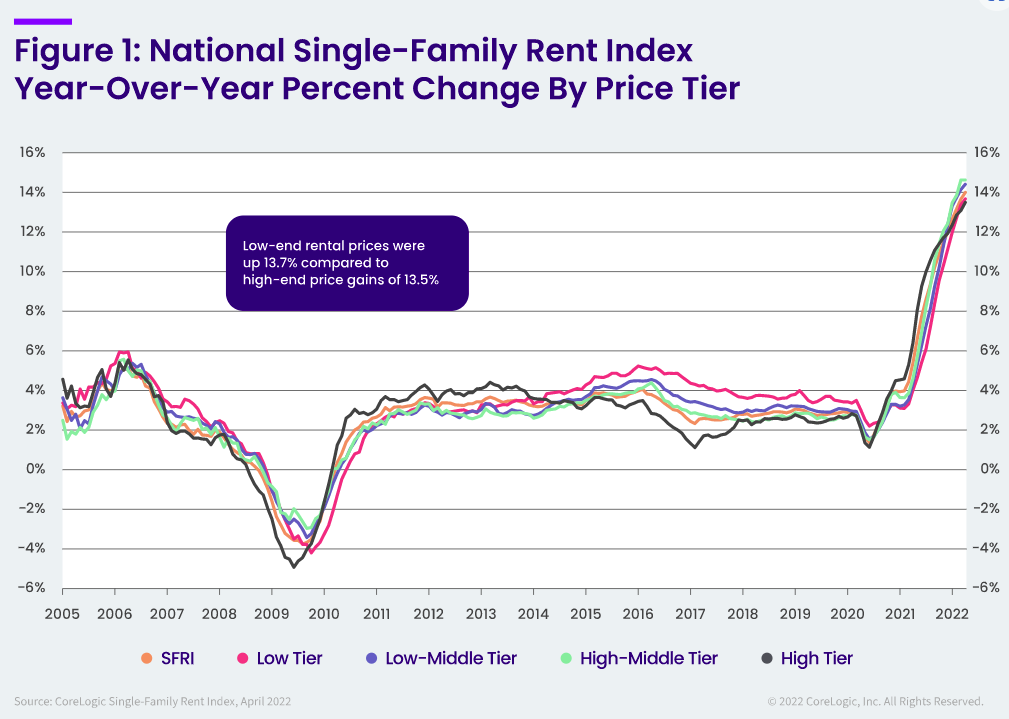

CoreLogic also tracks rents for single family homes: April Jump in US Rent Price Growth Puts Pressure on Inflation, CoreLogic Reports

CoreLogic … today released its latest Single-Family Rent Index (SFRI), which analyzes single-family rent price changes nationally and across major metropolitan areas.

U.S. single-family rent growth continued its hot streak in April, with prices up by 14% year over year, the 13th consecutive month of record-breaking annual gains. … The year-over-year U.S. rent price growth once again was more than double the April 2021 increase and more than six times higher than the April 2020 growth. …

“Single-family rents continue to increase at record-level rates,” said Molly Boesel, principal economist at CoreLogic. “In April, rent growth provided upward pressure on inflation, which rose at rates not seen in nearly 40 years. We expect single-family rent growth to continue to increase at a rapid pace throughout 2022.”

The 14.0% YoY increase in April was up from 13.6% YoY in March.

Rent Data

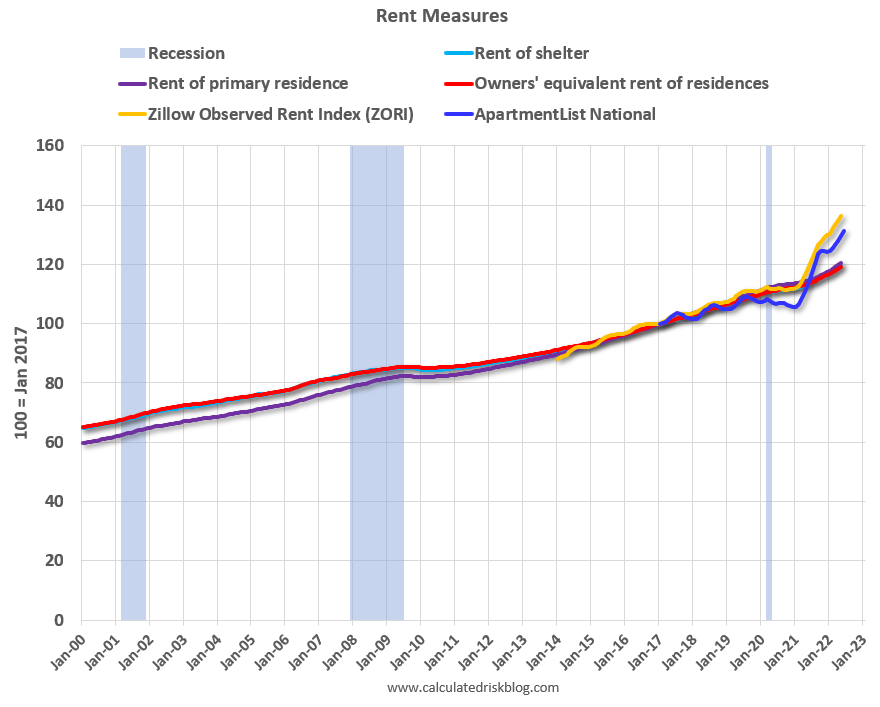

I’m going to update some of the data on rents. Here is a graph of several measures of rent since 2000: OER, rent of shelter, rent of primary residence, Zillow Observed Rent Index (ZORI), and ApartmentList.com. (All set to 100 in January 2017)

Note: For a discussion on how OER, and Rent of primary residence are measured, see from the BLS: How the CPI measures price change of Owners’ equivalent rent of primary residence (OER) and rent of primary residence (Rent)

OER, rent of shelter, and rent of primary residence have mostly moved together. The Zillow index started in 2014, and the ApartmentList index started in 2017.

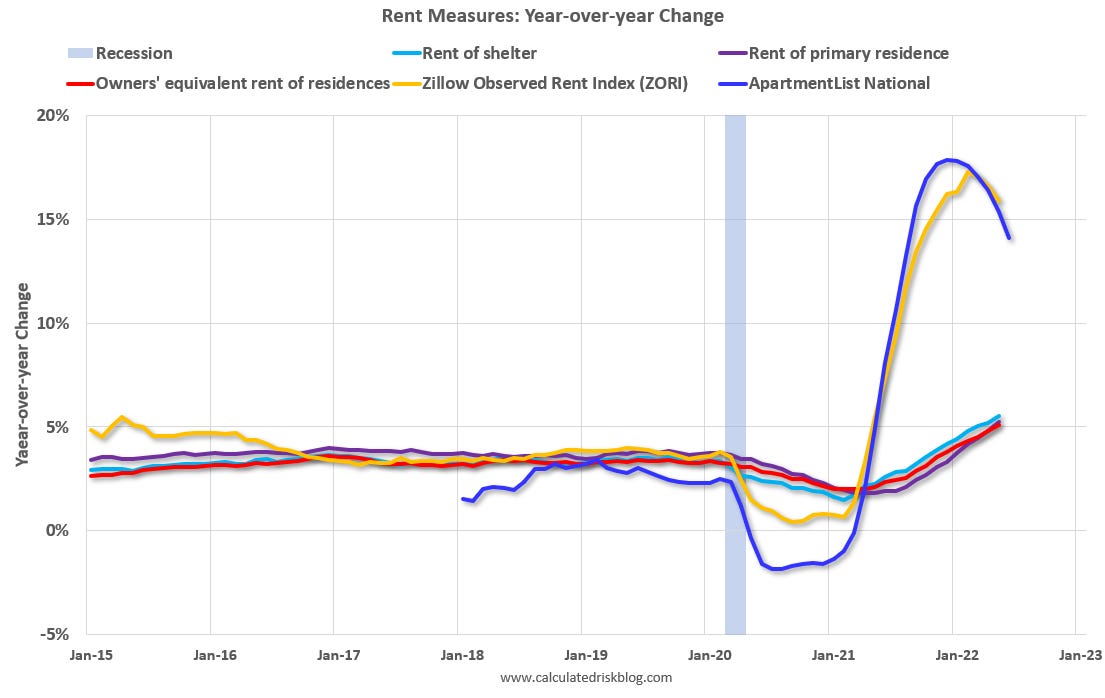

Here is a graph of the year-over-year (YoY) change for these measures since January 2015. All of these measures are through April 2022 (Apartment List through June 2022).

Note that new lease measures (Zillow, Apartment List) dipped early in the pandemic, whereas the BLS measures were steady. Then new leases took off, and the BLS measures are picking up.

The Zillow measure is up 15.9% YoY in May, down from 16.6% YoY in April. This is down from a peak of 17.2% YoY in February.

The ApartmentList measure is up 14.1% YoY as of June, down from 15.4% in May. This is down from the peak of 17.8% YoY last December.

Both the Zillow measure (a repeat rent index), and ApartmentList are showing a sharp increase in rents. From Zillow:

“ZORI is a repeat-rent index that is weighted to the rental housing stock to ensure representativeness across the entire market, not just those homes currently listed for-rent.”

And from ApartmentList:

At Apartment List, we estimate the median contract rent across new leases signed in a given market and month. To capture how rents change in a market over time, we estimate the expected price change that a rental unit should experience if it were to be leased today.

Both of these measures reflect new leases, whereas most rental units don’t turnover every year (as captured by the BLS measures). This sharp increase in new lease rates should spill over into the consumer price index over the next year (as discussed in earlier article).

Clearly rents are still increasing, and we should expect this to continue to spill over into measures of inflation in 2022. The Owners’ Equivalent Rent (OER) was up 5.1% YoY in May, from 4.8% YoY in April - and will likely increase further in the coming months.

My suspicion is rent increases will slow over the coming months as the pace of household formation slows, and more supply comes on the market.

https://calculatedrisk.substack.com/p/rent-increases-up-sharply-year-over-2e1

No comments:

Post a Comment