Will the end of the foreclosure moratorium, combined with the expiration of a large number of forbearance plans, lead to a surge in foreclosures and impact house prices, as happened following the housing bubble?

Some simple definitions (for housing):

Forbearance is the act of refraining from enforcing mortgage debt.

Delinquency is the failure to make mortgage payments on a timely basis.

Foreclosure is when the mortgage lender takes possession of the property after the mortgagor failed to make their payments. “In foreclosure” is the process of foreclosure.

At the onset of the pandemic, there was a large increase in the number of mortgagors entering forbearance plans with their lenders. This caused some concern that these forbearance plans would eventually lead to a significant increase in foreclosures.

Most of these forbearance plans were for 12 months, with up to 6 months of extensions - for a total of 18 months. Since many of these borrowers entered these plans in April and May of 2020, the 18 months will end in September and October 2021.

Some data on forbearance …

Both the Mortgage Bankers Association (MBA) and Black Knight are providing weekly estimates of loans in forbearance. An analyst at Black Knight wrote this morning:

According to Black Knight’s McDash Flash forbearance tracker, there are now 1.76 million borrowers who remain in COVID-19 related forbearance plans as of August 24 … That number ramps up to nearly 670,000 for September, though, with 415,000 of those plans set to reach their final expiration next month based on current allowable forbearance term lengths.

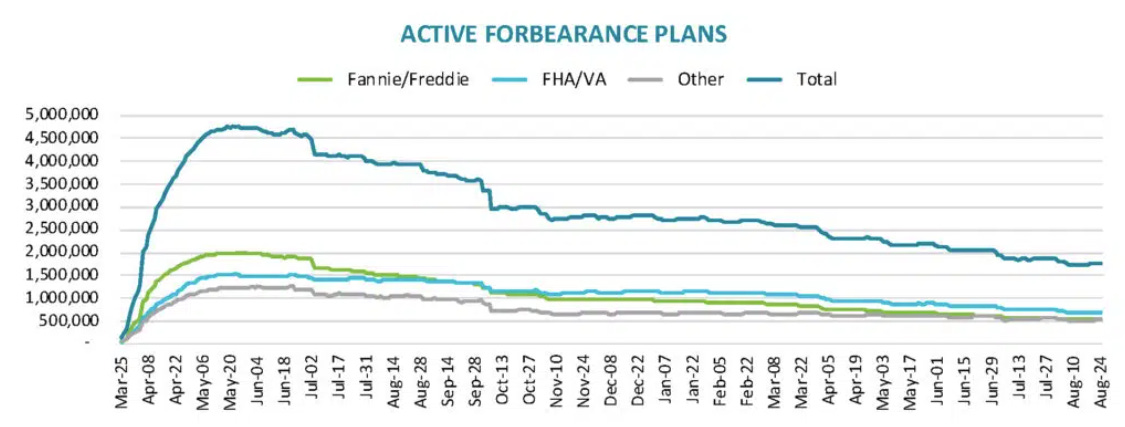

Here is a graph from Black Knight. The number of borrowers in forbearance peaked at about 4.75 million in May 2020, and is now down to 1.76 million. So 3 million borrowers have already exited forbearance plans.

And from the MBA this week:

According to MBA's estimate, 1.6 million homeowners are in forbearance plans.

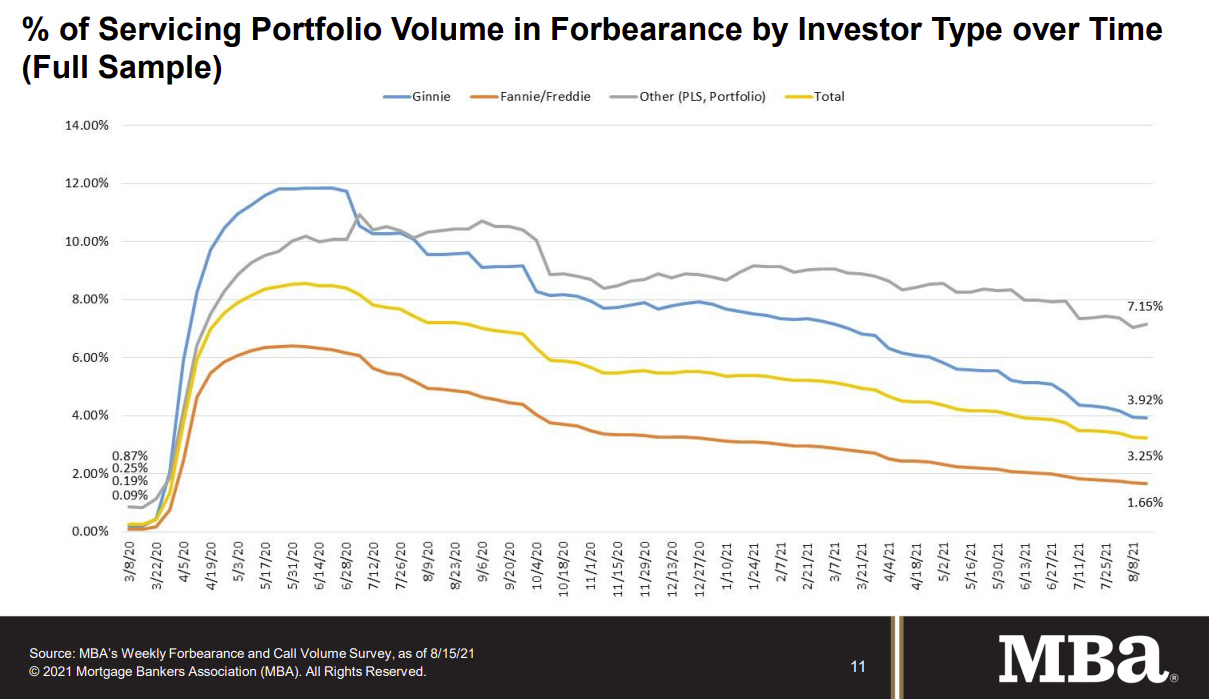

This following graph is from the MBA and shows the % of the portfolio in forbearance.

IMPORTANT: The concern isn’t just the 1.6 to 1.7 million borrowers still in forbearance plans, but also borrowers that have exited plans, and are not current. Here is some data from the MBA on the status of borrowers that exited forbearance plans:

Of the cumulative forbearance exits for the period from June 1, 2020, through August 15, 2021, at the time of forbearance exit:

28.3% resulted in a loan deferral/partial claim.

22.6% represented borrowers who continued to make their monthly payments during their forbearance period.

16.1% represented borrowers who did not make all of their monthly payments and exited forbearance without a loss mitigation plan in place yet.

13.1% resulted in reinstatements, in which past-due amounts are paid back when exiting forbearance.

11.1% resulted in a loan modification or trial loan modification.

7.4% resulted in loans paid off through either a refinance or by selling the home.

The remaining 1.4% resulted in repayment plans, short sales, deed-in-lieus or other reasons.

So some of the 3 million or so borrowers that have already exited forbearance plans are also not current.

Here is some data on delinquencies …

It is important to note that loans in forbearance are counted as delinquent in the various surveys, but not reported to the credit agencies.

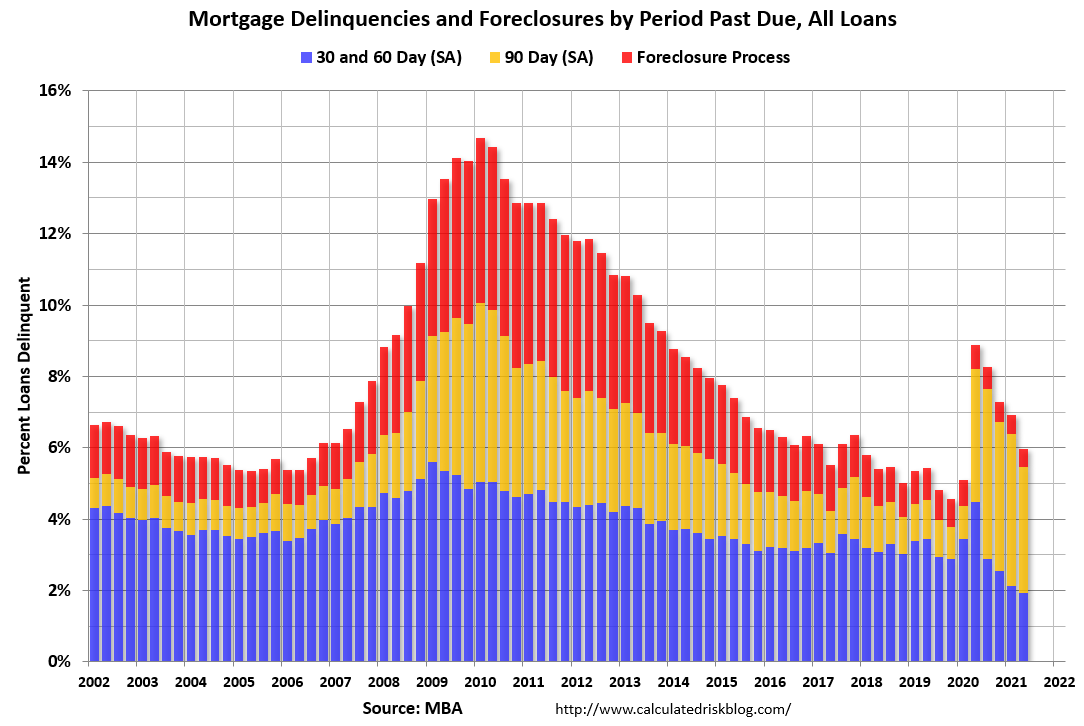

Here is a graph from the MBA’s National Delinquency Survey through Q2 2021.

Note that loans in the foreclosure process were at a record low in Q2 (there was a foreclosure moratorium that ended on July 31, 2021). And short term delinquencies (30 and 60 days) were also at a record low. Loans in forbearance are mostly in the 90 day bucket at this point, and that is the area of concern.

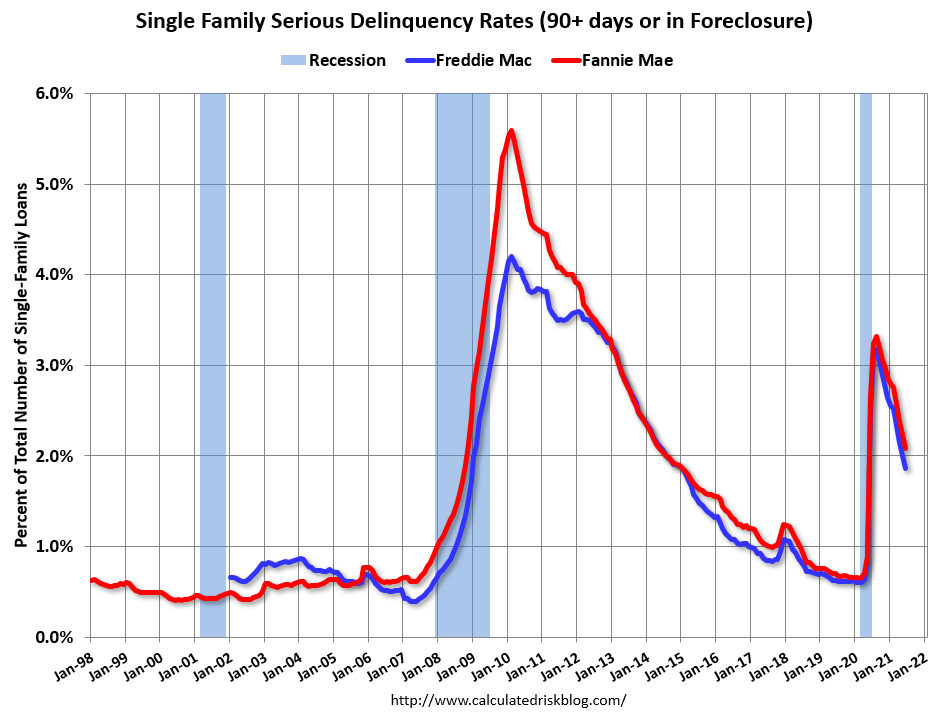

Both Fannie and Freddie release serious delinquency (90+ days) data monthly. Fannie Mae reported that the Single-Family Serious Delinquency decreased to 2.08% in June, from 2.24% in May. And Freddie Mac reported that the Single-Family serious delinquency rate in June was 1.86%, down from 2.01% in May.

This graph shows the recent decline in serious delinquencies:

The pandemic related increase in serious delinquencies was very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes - and they will be able to restructure their loans once (if) they are employed.

And on foreclosures …

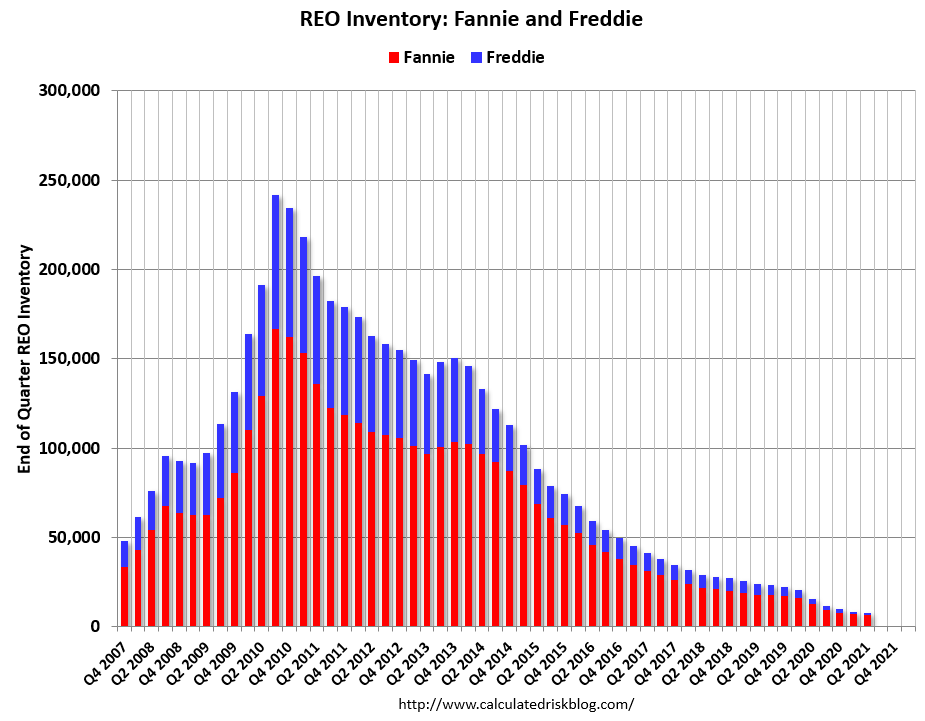

There are a record low number of properties currently in foreclosure due to the foreclosure moratorium that ended on July 31, 2021. Here is some data from Fannie and Freddie on Real Estate Owned (REOs).

Freddie Mac reported the number of REO declined to 1,477 at the end of Q2 2021 compared to 2,812 at the end of Q2 2020. Fannie Mae reported the number of REO declined to 6,363 at the end of Q2 2021 compared to 12,675 at the end of Q2 2020.

This is a record low number of REO as the following graph shows:

From Fannie:

"The decline in single-family REO properties in the first half of 2021 compared with the first half of 2020 was due to the suspension of foreclosures that began in March 2020 as a result of the COVID-19 pandemic. In response to the pandemic and with instruction from FHFA, we have prohibited our servicers from completing foreclosures on our single-family loans through July 31, 2021, except in the case of vacant or abandoned properties."

So we’d probably expect an increase in foreclosure activity to more normal levels once the foreclosure moratorium ended, even without COVID and the large number of borrows in forbearance plans.

However, even though the moratorium ended on July 31st, foreclosures will probably not increase much until 2022. From the Consumer Financial Protection Bureau (CFPB):

Starting August 31, 2021, most mortgage servicers must tell you about your repayment or other options when they reach out to you. Except in limited circumstances, before January 1, 2022, a servicer cannot start the foreclosure process without first reaching out to you and evaluating your complete application for options to help you avoid foreclosure.

Even if lenders start the foreclosure process in January, it will take several months for the foreclosure to happen (states have different processes, but it will usually take 4 to 6 months from filing to foreclosure).

Probably around 1 million or so borrowers will reach the end of their forbearance plan in September and October. But most of these borrowers will probably make their payments or restructure their loans. And even for those borrowers who are unable to make their payments, this doesn’t mean we will see a huge increase in foreclosures.

As Mike Simonsen, CEO of Altos Research wrote on Twitter this week:

With house prices up sharply year-over-year - up 16.6% nationally in May according to Case-Shiller - very few borrowers will have negative equity, and most seriously delinquent borrowers will be able to sell their house, as a last resort, and avoid foreclosure.

So, although foreclosures will increase from the record low levels, it will take some time (probably in 2022), and there will not be a huge wave of foreclosures like following the housing bubble.

https://calculatedrisk.substack.com/p/forbearance-delinquencies-and-foreclosure

No comments:

Post a Comment