The past year has been a fiscal nightmare for Nashville. Covid-19 helped punch a $332 million hole in the city’s $2.46 billion budget. Tennessee state comptroller Justin Wilson warned that, without drastic action, the state might take over management of Nashville’s affairs. In response, the city council raised property taxes 34 percent, spurring a citizen revolt in the form of a ballot initiative to overturn the tax hike. Without the extra revenue, however, Mayor John Cooper’s administration said that drastic cuts would be unavoidable: “Few corners of the Metro government, including emergency services and schools, would be spared significant reductions or eliminations.”

Nashville’s budget woes predate the pandemic: the city began borrowing money to cover deficits after the Great Recession of 2008–09. City leaders, at the same time, went into heavy debt to build new government-owned attractions, offered workers health retirement benefits that they haven’t funded, and deep-sixed pension reforms that saved the state billions of dollars. In fact, back in December 2019, the state comptroller issued a similar warning to Nashville about its shaky finances.

The Music City isn’t alone. The Covid health emergency and accompanying economic downturn caused budget crises for municipalities—cities, counties, and school districts—across America. A February letter from 400 mayors to President Biden said that the pandemic-inflicted strain on municipal budgets had “resulted in budget cuts, service reductions, and job losses” throughout local government. America’s largest city, New York, grappled with a nearly $10 billion budget deficit in the spring of 2020, while Chicago struggled with a $2 billion gap. Dozens of local governments used the crisis to justify budget maneuvers that fiscal experts generally frown upon, from borrowing money to close deficits to issuing bonds to fund employee pensions.

But as with Nashville, the fiscal difficulties afflicting many local governments over the last year result from bad financial practices that preceded the pandemic and left cities and school districts ill-prepared to cope with shutdowns. Some governments—again, like Nashville—began borrowing money to close budget deficits after the last recession a decade or more ago and never dug out from those debts. Others, including a number of California municipalities, built up such large funding gaps in their pension systems that, even during the long national economic expansion prior to 2020, they were using pension-obligation bonds (POBs) to conceal their problems. One study assessing the fiscal health of America’s biggest local governments for the immediate pre-pandemic period found that 62 cities lacked the resources to pay all their bills. “This means that to balance the budget, elected officials did not include the true costs of the government in their budget calculations and pushed costs onto future taxpayers,” the study concluded.

Even the tens of billions of dollars the Biden administration is showering on local governments won’t fix their long-term financial troubles. Only genuine reforms that banish unsound budget practices and use economic expansion to prepare for fiscal downturns will reverse a trend that has seen local governments go into hock and stay there for extended periods—at great cost to their residents.

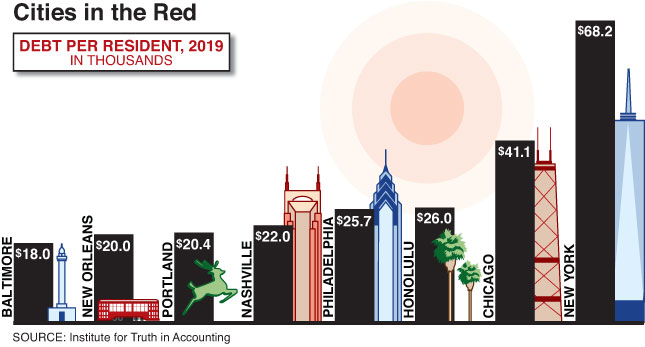

The financial state of America’s largest cities heading into the Covid-19 crisis was worse than the reports on the budgetary fallout from lockdowns generally acknowledge. An Institute for Truth in Accounting study of the nation’s 75 largest cities, based on their 2019 comprehensive annual reports, found that, collectively, they owed a jaw-dropping $333.5 billion more than they had saved. Much of that debt, moreover, is for benefits that employees had already earned but that cities have yet to fund. “One of the ways cities make their budgets look balanced is by shortchanging public pension and OPEB [retiree health benefit] funds,” the institute noted.

Distressingly, the study found that only 13 cities legitimately balanced their budgets—that is, paid all their bills without using fiscal gimmicks such as pushing off into the future payments that they should be making now. The study identified a few winners, including Irvine, California; Lincoln, Nebraska; and Charlotte, North Carolina. But for other cities, the picture is darker. Among those with future obligations far outstripping current resources are New York, which collectively owes $194 billion that the city hasn’t funded, or $68,000 per every city taxpayer; Chicago, with an unfunded debt load of $36 billion, or $37,000 per taxpayer; and Nashville, with $4.3 billion in debt that it doesn’t have resources to pay, amounting to $22,000 per taxpayer.

New York headed into 2020 after a decade of prosperity that saw the city’s economy add hundreds of thousands of new jobs and government boost spending by nearly 50 percent, or $29 billion. Led by Mayor Bill de Blasio for much of that period, New York largely spent that affluence to fatten government, doing little to bank money for a rainy day or reduce its growing unfinanced debts. When Covid struck, de Blasio declared that the city faced a “wartime budget” that would force it to slash some $3.5 billion immediately and perhaps an equal amount in the coming fiscal year. Among other things, the administration moved to reduce basic services like trash collections and cut the number of traffic cops on duty.

Much of New York’s budget mess owed to its extraordinary workforce costs, which far exceed those of other cities. Rather than try to restrain those costs, de Blasio—elected with heavy support from public-sector unions—expanded the size and price of the city’s workforce over eight years. During his tenure, increases in compensation accounted for half the budget’s expansion, with the city workforce growing at the fastest rate in decades—adding 30,000 workers at an average cost of $151,000 per worker.

One example of the excesses: Gotham has made lavish promises to workers to finance their health care in retirement, with virtually no contribution from workers themselves—something rare in the private sector and most of government. Every year, the future cost of funding these promises swells by more than $5 billion. Instead of putting this money aside (or reducing the benefit to more affordable levels), the city spends its tax revenues elsewhere—so that, during de Blasio’s tenure, this debt rose from $75 billion to roughly $115 billion. Meantime, the annual cost of paying the benefit itself, which must come out of the city’s everyday budget, has reached about $3 billion and will double in the next decade. By then, without some effort to pay off the debt or reduce the benefits, the city will owe $200 billion for retiree health care that it hasn’t financed. What money the city had put aside for long-term health costs (just 4 percent of what it owed), de Blasio promptly swiped to help close its pandemic budget gap.

Other thriving cities also spent the pre-virus years mortgaging their futures. Nashville has been a boomtown over the last decade, its population up 12 percent, the local economy growing by some 300,000 new jobs, and its tax revenues expanding 50 percent. Yet in the familiar pattern, at the first sign of economic slowdown a decade ago, city leaders chose not to restrain budget growth but instead engineered a notorious “scoop-and-toss” financing scheme—issuing bonds to make payments on current debt (thus, scooping up current obligations and tossing them into the future). At the same time, aspiring to be a world-class city, Nashville borrowed hundreds of millions of dollars to build tourist attractions, from the Music City Center to a minor-league baseball stadium to an amphitheater. The city’s debt payments have thus rocketed from about $80 million in 2011 to $330 million last year. Nashville is also on the hook for $110 million in annual payments to fund its expensive pension system—this, after city leaders refused several years ago to sign on to a pension-reform agenda that Tennessee enacted, which has dramatically slowed the growth of state retirement debt.

Before Covid, Chicago had enjoyed a decade of economic growth, which saw its job numbers climb by 100,000 and its unemployment rate sink to an impressive 3.1 percent by late 2019. But it had also become America’s second-most indebted major city by spending well beyond its prosperity, failing to fund its pension system adequately, using nonrecurring revenues from the sale of city assets to fund popular programs, and regularly issuing new debt to kick current obligations into the future. The annual cost of Chicago’s severely underfunded pension system was so high that the payments consumed all the city’s property taxes; next year, that bill will rise by another $432 million, to $2.2 billion. Chicago spent years after the recessions of 2001 and 2008 borrowing money to finance everyday operating expenses—about $4.5 billion in debt to pay for spending beyond what city revenues could bear. Chicago’s debt payments have exploded to $800 million annually.

Mayor Lori Lightfoot admitted that more than half the city’s projected 2021 deficit was due to its poor finances. And the debt blowout continues. Recently, at the behest of union officials, the state passed an enhancement of Chicago firefighters’ pensions that will add $800 million in new debt to their pension fund, which was only 20 percent funded pre-pandemic. The health emergency has sent Chicago back to the practice of deficit financing. Once the lockdowns began, Chicago had to borrow some $500 million in low-interest short-term loans just to pay its bills, and Lightfoot’s original budget for next year called for a $1.7 billion deficit financing to balance its budget. The federal stimulus, providing the city with $2 billion, will help smooth over budget problems in the short term, though Lightfoot hasn’t discounted future borrowings.

Bad fiscal practices like these are increasingly common among local governments, which claim that Covid-19 required extraordinary measures. A recent study by Matt Fabian and Lisa Washburn of Municipal Market Analytics, examining 442 municipal bond offerings in the second half of 2020, found that at least a quarter used the money for “direct deficit financing” (floating new debt to close budget gaps) or “indirect deficit refinancing” (issuing debt to pay for projects that governments previously had financed with tax revenues). That so many local governments resorted to such financing so quickly—just months after the lockdowns began—suggests how little financial flexibility and reserves many of them had.

Pennsylvania school districts, for instance, have faced huge increases in pension costs because of years when the state legislature awarded benefits to school employees without doing enough to demand that they be funded. With the state teachers’ pension system just 55 percent funded, the state and local districts this year must split a tab amounting to 35 percent of salaries—up from just 8 percent a decade ago. To deal with that burden, some districts resorted to deficit financing after the coronavirus hit. Riverside, a small district near Scranton, has seen its pension payments rise by 75 percent in just five years, to $3.6 million, or 14 percent of its budget, according to its bond documents. Late last year, it floated $1.9 million in bonds that Moody’s described as a scoop-and-toss offering. Rochester, another small Pennsylvania district, confronted some $5 million in debt payments in 2021 and issued approximately $5.4 million in new bonds with later maturities to give itself more time to cut costs and figure out how to repay creditors. Its overall debt swelled.

Questionable financial transactions can spread in states and metro regions like a contagion. Hartford, Connecticut, began using deficit financing to disguise its budget problems after the last recession. Issuing about $200 million in new debt about eight years ago, Hartford eventually found itself struggling with exploding debt payments, which went from $10 million annually to $54 million. The city reached the brink of bankruptcy before the state took control of its finances and engineered a $534 million bailout. Even so, in 2018, nearby New Haven resorted to the same maneuver, floating $160 million in scoop-and-toss debt, though city leaders pledged fiscal prudence to avoid Hartford’s fate. In 2020, New Haven grappled with a new $66 million deficit, which officials described as a “crisis” budget. Though the pandemic worsened the shortfall, much of the problem was structural—that is, the long-term result of the city spending more than it took in. New Haven’s debt service alone comes to $62 million annually; its pension costs have risen $23 million, or 37 percent, in just five years. Nearby Hamden, a community of 60,000, resorted to its own deficit financing last summer, seeking to avoid a cash crisis. It’s now counting on $20 million or so from the Biden stimulus to help ease its budget shortfall.

Low interest rates, propelled in part by the economic downturn, have helped spur a resurgence of another discredited funding tool: the pension-obligation bond. Governments use these bonds to raise money to make their pension systems look better financed, but in doing so, they add new debt to their balance sheets. The rationale for these POBs is that municipalities can borrow money and pay back creditors at 3 percent to 4 percent, and then invest the proceeds in their pension funds to earn 7 percent or more—the typical target for stock-market returns of most public pension systems.

What this thinking overlooks is that markets don’t just rise; they also fall, and pension funds in the past have lost money that they borrowed. That risk is what led the Government Finance Officers Association to issue a warning: “POBs involve considerable investment risk, making this goal [of achieving adequate investment returns] very speculative,” the organization says. “In recent years, local jurisdictions across the country have faced increased financial stress as a result of their reliance on POBs, demonstrating the significant risks associated with these instruments for both small and large governments.” Those risks are especially steep now, with the stock market at an all-time high, rebounding by 79 percent since its March 2020 selling frenzy.

Pension-obligation bonds played a role in some notable municipal bankruptcy cases after the last recession. Stockton floated some $125 million in bonds in 2007 and gave the proceeds to the California state pension system to invest. The city promptly lost one-quarter of that money in the market decline of 2008. Coupled with Stockton’s already-inflated pension obligations, the losses helped drive the city into bankruptcy. Detroit, for its part, engineered a $1.4 billion offering in 2006, using a complex funding structure that sought to borrow in a way that evaded state debt limits. The added debt led a financial trustee, brought in to manage the city’s affairs, to seek bankruptcy on its behalf. Bondholders wound up getting just 14 cents on the dollar for what remained of the debt; city workers took an approximate 9 percent cut in their pensions.

Despite warnings, the use of pension-obligation bonds has exploded. States and municipalities issued $6 billion in POBs last year, double the previous year’s volume. And more borrowing is coming. “We see no signs of slowing down in 2021,” Todd Kanaster, director for municipal pensions at S&P Global Ratings, predicted. Just a few months into 2021, several cities had already completed enormous POB offerings. Huntington Beach, a midsize California community of 200,000 people, issued $436 million in POBs in March, a sum more than twice its $217 million general fund budget. The city, like many California communities, justified the move because the bill for financing its pensions had risen from $4.6 million in 2008 to $30 million last year. The city is looking at a potential annual bill of $40 million by 2024. But Huntington Beach compounded its fiscal distress when it gave workers raises last April, adding $5 million to its budget over the next three years. Several months later, the city admitted that it expected a $20 million decline in revenues due to the pandemic, and officials began exploring the possibility of raising money in the bond market.

California cities can issue these bonds thanks to a 2007 state supreme court ruling that exempted pension borrowings from a law requiring municipalities to get voter approval for new long-term debt. The ruling, combined with rapidly growing pension costs for local municipalities—collectively, they’ll have to ante up $5.3 billion in 2022, just to cover unfunded retirement debt—has municipalities heading to the bond market, despite the risks. Chula Vista, San Diego County’s second-largest city, with a population of 275,000 and a general fund budget of $197 million, borrowed $350 million earlier this year to offset the rise of its pension costs, which have hit $30 million annually. Much of the city’s fiscal problems go back to generous enhancements to pensions that officials agreed to years ago, allowing workers after 30 years of service to retire at age 60 with pensions at 90 percent of their salaries. So onerous are those promises that the city’s pension debt kept rising, even during the pre-Covid stock-market boom. From 2015 through 2019, the city’s unfunded pension debt increased to $355 million from $234 million, as the S&P 500 was rising by nearly 50 percent.

Huge offerings like these are spreading—and getting ever more creative. Municipalities in Arizona are plagued by huge debts in the state’s public-safety pension systems, which are less than 50 percent funded. To help reduce annual required payments, Tucson raised $659 million earlier this year from a controversial form of borrowing that utilizes so-called certificates of participation. In essence, Tucson sold assets that it owns, including golf courses and a zoo, to a shell corporation, which rented them back to the city. The corporation then sold the certificates, a form of bond, to investors, who will get paid with the “rent” that the city is paying itself. Tucson is depositing the $659 million in its pension fund, hoping for fat investment returns. Some 140 miles north, Flagstaff rented its libraries and other facilities, including City Hall, to itself in order to raise $112 million. If the pension system hits its investment targets, the move will save the city $76 million over 20 years. That’s a big if, though. Certificates of participation carry significant risks. They were behind Detroit’s disastrous pension borrowing back in 2006.

According to many local leaders, the lockdowns brought a budget crisis that could be solved only through extraordinary federal government aid. The Biden stimulus package certainly delivered, dedicating an unprecedented $130 billion to municipalities, on top of hundreds of billions sent to state governments. Yet any survey of what governments owed, and how persistently they failed to balance budgets even during good times, makes it clear that the stimulus money won’t fix the fiscal mess. Pre-Covid, the largest American cities already owed about two and a half times what the administration is showering on localities. All that debt weighs on budgets even when the economy is racing; it becomes a crushing burden after the economy slows down.

The public-health crisis has blunted local reform efforts. Early last year, then–California state senator John Moorlach proposed legislation that required municipalities to get voter approval before they could issue pension-obligation bonds. But as the virus surged, California’s legislature shelved the bill. Free to pile up new debt, state municipalities issued $3.7 billion in POBs in 2020, and they’re adding more in 2021.

Post-Covid, will states try to restrain local governments’ addiction to deficit financing? Officials could pass laws, like Moorlach’s proposed measure, that mandate voter approval of questionable fiscal maneuvers. Or they could ban such tools outright. More broadly, states could impose sensible changes in government accounting principles that make elected officials acknowledge—and pay for—the true cost of their profligacy. Though most states require local governments to balance their budgets, current accounting principles ignore some of the basic costs that those governments incur, such as retirement benefits. Thus, New York City can promise workers every year $5 billion in future retirement health benefits, without needing to finance those benefits today. Compelling elected officials to account for the present value of such benefits (which, in New York’s case, would be less than $5 billion but still substantial) and set aside money out of their current budget to pay for them would reveal the benefits’ true costs. Local officials would have to finance them now—rather than leave the bill to someone else—or reform local spending and avoid unsustainable commitments.

Retirement reforms in many places have been anemic, at best. The state and local pension crisis is now 15 to 20 years old. Many governments lost the opportunity to address it when the debt was manageable. After the 2008 financial crisis, dozens of states claimed that they’d made changes to fix their imbalances. Few succeeded. Most reforms were superficial. If governments had enacted true reforms back then—switching workers to defined-contribution plans that don’t leave taxpayers on the hook for investment shortfalls, or creating hybrid plans that offer workers a small annuity combined with an investment savings account—the situation would look much better.

It’s becoming increasingly clear that local governments are not about to grow their way out of their long-term budget problems, even when the economy booms. Only reforms that force them to confront the true cost of their bills will stem the rise in bad budgeting that leaves them unprepared for any but the best of times.

No comments:

Post a Comment