As if the ongoing moratorium on evictions (which shows literally zero signs of ever going away) wasn't enough government "relief" for those suffering at the hands of the government mandated Covid lockdowns, the Biden administration is now going to be implementing a policy to reduce monthly payments by up to 25% for borrowers with federally backed mortgages who are at the end of forbearance.

The program is going to allow those with mortgages from the Federal Housing Administration to extend the length of their mortgages and lock in lower monthly principal and interest payments, according to the Wall Street Journal. The changes are targeted toward those who took advantage of government forbearance programs that allowed them to skip payments for up to 18 months and still can't make payments on time - which we're guessing is going to amount to precisely everybody.

Most borrowers who took on forbearance plans at the beginning of the pandemic will start to see them expire around September and October and the country's national foreclosure ban expires July 31. About 75% of new home loans are currently backed by the federal government, the Journal reports.

Bob Broeksmit, president and chief executive of the Mortgage Bankers Association, said that the new modifications are “an important additional step to give people the opportunity to stay in their homes after they had a hardship during the pandemic.”

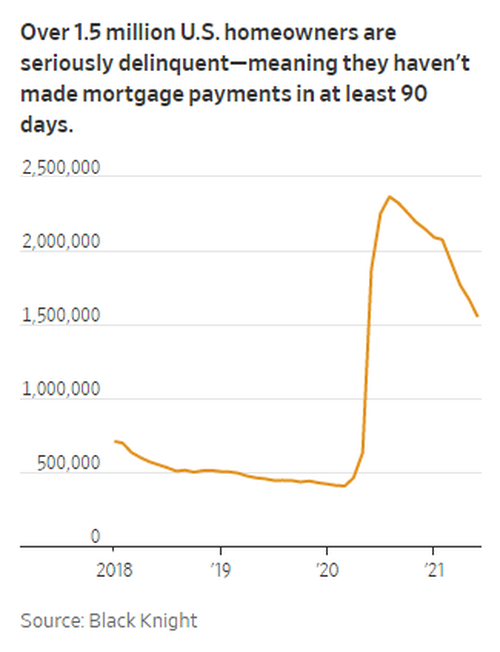

As of now, about 1.55 million homeowners haven't made mortgage payments in the last 90 days. The "bulk" of these homeowners have forbearance plans and are at risk of foreclosure. They make up a 2.9% slice of the 53 million active mortgages, down from 4.4% in August and September 2020, the report notes.

Many of the borrowers who the new program will affect "have lower incomes and make smaller down payments than people with other government-backed loans", the report notes. Many have also been hit by job losses as a result of the pandemic. Advocating for the program, Broeksmit continued: “People don’t enter into mortgage borrowing with the notion that they can’t afford the payment.”

And in addition to this planned new aid, a $47 billion federal program has already been implemented to help tenants who can't pay rent due to Covid. The Journal notes that state and local governments are "struggling to distribute the money," however.

Isaac Boltansky, director of policy research at Compass Point Research & Trading said: “If a reduction in monthly costs helps keep that borrower in their home until they are back on their feet, then it is a win for the borrower, policy makers, and Uncle Sam, as he owns the credit risk.”

We're not sure that you know exactly what the words "credit risk" mean, Issac. But, we digress.

No comments:

Post a Comment