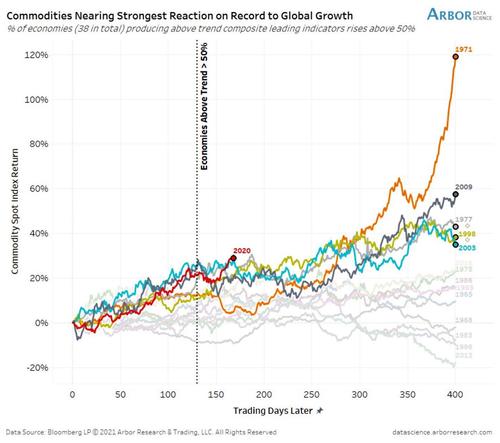

With BofA predicting that the US is facing a period of "transitory hyperinflation" as a result of soaring commodity prices in everything from metals to food...

.... and beyond, in what increasingly more warn is a stagflationary burst right out of the 1970s playbook...

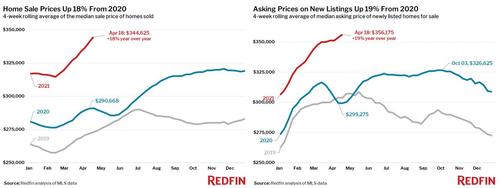

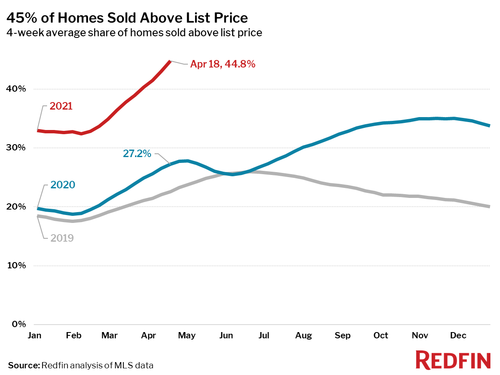

... it makes sense that home prices are also surging thanks to trillions in stimmy checks, near-record low mortgage rates and an exodus away from cities, and as we noted two weeks ago that's precisely what they are doing, with Redfin reporting an 18% jump in median home sale prices to an all time high...

... as a record 58% of all houses sell within two weeks of listing, of which 45% sell for more than their listing price, also a record.

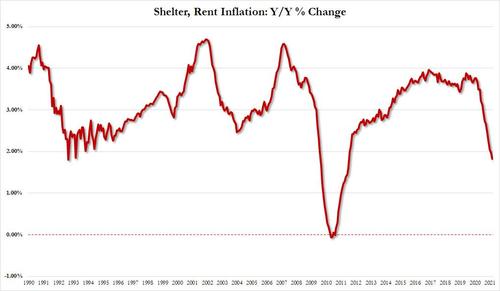

Amid this dismal "transitorily hyperinflationary" landscape, where those whose incomes aren't similarly hyperinflating find themselves at risk of being unable to afford a roof above their head, there was one ray of hope: renting, with rent prices tumbling in recent months and according to the BLS' monthly CPI metric, rent inflation had just dropped to the lowest in a decade, just below 2.0% annually...

... which due to the way the CPI basket is weighted acted as a key anchor on overall CPI rates, and served to distort the broader inflationary picture. In short, the Fed would look at the relatively tame core CPI which was only tame thanks to "tumbling" rents and would conclude that there is nothing to worry about.

Only, as we first discussed three weeks ago, it now appears that not only was the government misrepresenting the actual data in hopes of extracting as much stimulus from the Biden regime by pretending inflation is low and "contained", but that rents are in fact soaring once again.

As we reported at the start of May, American Homes 4 Rent, which owns 54,000 houses, increased rents 11% on vacant properties in April, the company reported in a statement:

... Continued to experience record demand with a Same-Home portfolio Average Occupied Days Percentage of 97.3% in the first quarter of 2021, while achieving 10.0% rental rate growth on new leases, which accelerated further in April to an Average Occupied Days Percentage in the high 97% range while achieving over 11% rental rate growth on new leases.

Invitation Homes, the largest landlord in the industry, also boosted rents by similar amount, an executive said on a recent conference call. Or, as Bloomberg puts it, record occupancy rates are emboldening single-family landlords to hike rents aggressively, testing the limits of booming demand for suburban rentals.

While soaring housing costs had put homeownership out of reach for most Americans, rents had been relatively tame for much of 2020. But in recent months, rents have also soared as vaccines fuel optimism about a rebound from the pandemic, and a reversal in the city-to-suburbs exodus. The increases, as Bloomberg so eloquently puts it, "may add to concerns about inflation pressures."

“Companies are trying to figure out how hard they can push before they start losing people,” said Jeffrey Langbaum, an analyst at Bloomberg Intelligence. “And they seem to be of the opinion they can push as far as they want.”

Fast forward to today when we have definitive proof that the companies were right.

According to the June Apartment List National Rent Report, the national rent index increased by 2.3% from April to May, the largest single month increase ever recorded in AL estimates, which begin in January 2017. It was also the third straight month in which that record has been broken, following a 2.0 percent increase last month and a 1.4 percent increase in March.

In March, prices rebounded to their pre-pandemic levels. This month, we hit a new milestone -- our national index is now above the level where we project it would have been if the pandemic-related price declines of 2020 had never occurred at all.

After this recent spike, year-over-year rent growth now stands at 5.4% nationally, and prices are now above the level where rents would have been if the pandemic-related price declines of 2020 had never occurred at all.

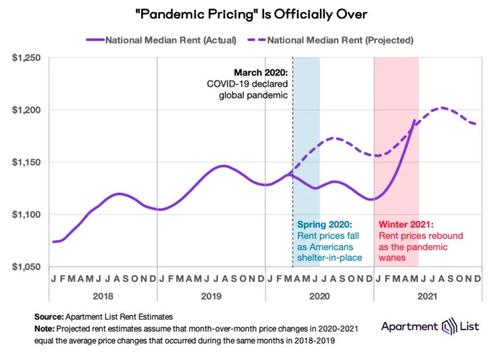

In the chart above, AL plots the national median rent from 2018 to present. The data for 2018 and 2019 depicts the smooth seasonality of a typical year, in which prices peak during the summer busy season and then dip slightly in the winter off-season. Overall, prices increased by 2.9 percent in 2018 and 2.1 percent in 2019. 2020 represents a clear break from this trend, with rents declining in the early months of the pandemic during what is normally peak-season. The dashed line in the chart represents a projection of how rents would have changed over the past year in the absence of the pandemic. This projection is based on an average of the growth rates that we observed in 2018 and 2019. Actual rent growth had been trailing this projection since the start of the pandemic, but this month’s record setting growth has now put actual rents ahead of the projection. Year-over-year rent growth now stands at 5.4 percent, another record.

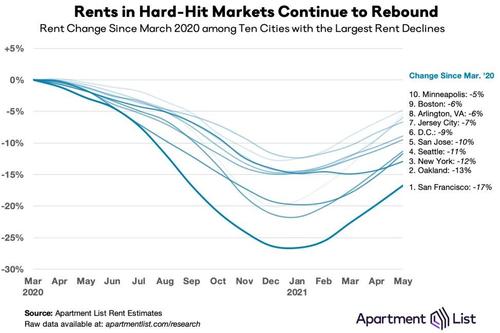

To be sure, there is significant regional variation in rent trends, and prices in a number of markets are still well below pre-pandemic levels. That said, even in these markets, prices are rebounding rapidly. San Francisco headlines throughout the pandemic for the staggering 26.6 percent drop in rents from March 2020 through January 2021, but since January, San Francisco rents have increased by 13.4 percent. Although rents in San Francisco are still 16.8 percent below pre-pandemic levels, the market has clearly turned a corner, and the best deals appear to be behind us.

San Francisco aside, there is a similar trend across the rest of the country where rents had been falling fastest. Nine of the ten cities with the sharpest year-over-year rent declines have now experienced positive rent growth for four consecutive months. Four of these cities -- San Jose, Washington, D.C., Boston, and Minneapolis -- have seen rents increasing for five consecutive months. The following chart shows month-over-month rent growth from 2018 to present for six of the cities that have been hit hardest by the pandemic:

As AL notes, in each of the six cities shown, the fastest single-month rent increase has taken place in 2021. Rents are still below pre-COVID levels in each of these cities, but they’re quickly catching up. Nowhere is the trend stronger than in Boston, where prices have increased by an average of 3.4 percent per month in 2021 - if that pace continues, Boston rents will surpass March 2020 levels by mid-summer.

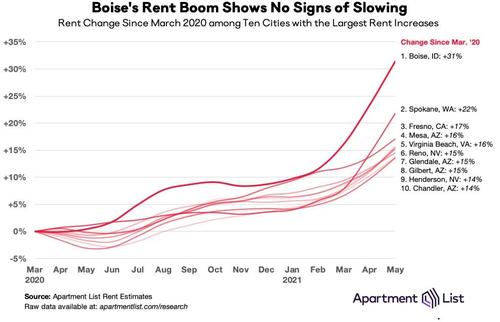

But if prices are rebounding sharply in traditional coastal markets, the market is nothing short of frenzied across another group of mid-sized markets. The pandemic and remote work spurred demand for the space and affordability that these cities offered, and in response, rent prices grew even as the surrounding economy struggled. But while rent declines in expensive markets have reversed course, the cities where rents have been growing fastest are continuing to boom. For the clearest example, no further than Boise, ID where the average rent has soared by 31% in the past year!

As ApartmentList notes, Boise, ID is leading the list, where rents grew by a staggering 6.6% over just the past month. This is the fastest month-over-month growth rate among the nation’s 100 largest cities, and Boise also continues to rank #1 for fastest year-over-year growth, which now stands at 30.8 percent. All of the 10 cities where rents have grown fastest since the start of the pandemic continued to see increases this month.

Many of these markets had been heating up prior to the pandemic. For example, from January 2017 to January 2020, rents in Mesa, AZ increased by 25.5 percent, the fastest growth in the nation over that period. Fresno ranked third for fastest rent growth from 2017 to 2020, while Chandler, AZ ranked sixth. Eight of the ten cities with the biggest pandemic booms were in the top 20 for pre-pandemic growth from 2017 to 2020. The pandemic did not necessarily start a new trend in these markets, so much as accelerate an existing one. This stands in contrast to what has happened in the expensive markets discussed above, for which the rent declines of the past year were a complete aberration. Given this longer-term context, as well as the continued upward trajectory in rent trends, it seems that Boise and cities like it have yet to hit their peaks.

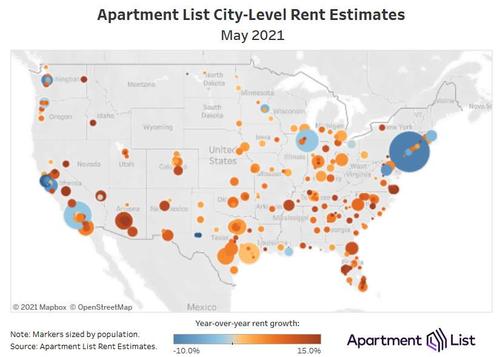

As the Apartment List concludes, the pandemic created some truly "transitory" softness in the rental market last year, and in response, 2021 has seen some of the fastest rent growth we have on record in our data. Nationally, rents have now surpassed the level where they would have been if rent growth had not been disrupted by the pandemic. In markets like San Francisco where rents had been falling fastest, prices have turned a corner and are now rebounding. At the same time, booming markets like Boise continue to see prices climb. More broadly, rental inventory across the nation remains tight, and as vaccine distribution continues to gain momentum, we may be seeing even higher prices as a result of released pent up demand from renters who had been delaying moves due to the pandemic. Whereas last year’s peak moving season was halted by the pandemic, this year’s seasonal spike appears to be making up for lost time.

Summary: surging rents - the "missing piece" from both the CPI and PCE baskets - are back with a vengeance, and the result is that no matter which official inflation metric one uses, we are about to see some truly epic numbers in the coming weeks.

https://www.zerohedge.com/economics/and-now-prices-are-really-soaring-may-rent-jump-biggest-record

No comments:

Post a Comment