As the number of coronavirus cases escalates, the outbreak and a

sharp drop in tourism from China could have a significant impact on

America’s hotel market. Washington D.C.

The daily death toll from the coronavirus surpassed 100 for the

first time Tuesday, the Associated Press reports, pushing the total

number of deaths above 1,000.

The number of total cases on the Chinese mainland reached more than

42,000. The spread of the virus led several airlines, including United,

American and Delta, to halt trips between the U.S. and China. The

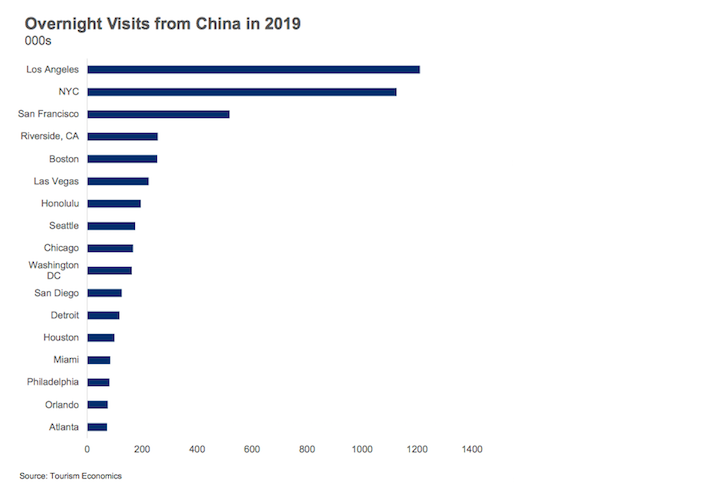

number of visits from China to the U.S. is expected to drop 28% this

year, according to a report from Tourism Economics. That drop in

tourists is expected to lead to a $5.8B loss in visitor spending this

year across the U.S., and the loss of 4.6 million hotel room nights, the

report found.

Last year, Chinese visitors to the U.S. spent $34B on travel and

transportation costs, representing 16% of all international travel

spending in the country.

“When you’re looking at the strongest market in terms of economic

impact and spend not being able to travel to the U.S., there’s nothing

ever good about that from our perspective, so there remains a degree of

concern,” said Destination D.C. President and CEO Elliott Ferguson, who

also serves as chair of the U.S. Travel Association.

The Tourism Economics report made its projections by looking at

historical precedents such the SARS crisis in 2003 and its impact on the

hotel market. STR Senior Vice President of Lodging Insights Jan Freitag

said because of the way the coronavirus spreads and the airlines

halting flights, it could lead to a larger impact on the hotel market

than the SARS virus.

“It is possible the impact could be more pronounced because of this complete travel shutdown,” Frietag said.

The decline in Chinese tourism could hit the D.C. area especially

hard. China has been the No. 1 country for tourists coming to D.C. since

2013, and roughly 226,000 Chinese tourists visited D.C. in 2018,

according to Destination D.C., the city’s tourism organization.

While the number of Chinese tourists coming to D.C. in 2018 was

down 25% from the prior year, those tourists stayed for longer periods

of time. The number of hotel room nights for Chinese tourists in 2018

was 442,000, up 72% from the prior year, according to Destination D.C.

Total spending from all visitors to D.C. in 2018 was a record $7.8B.

Destination D.C. has also taken special steps to court travelers from

China, including a program called Welcome China, which certifies hotels

and other businesses that are trained to accommodate Chinese travelers.

Ferguson said Destination D.C. was scheduled to travel to China later

this month but has postponed that trip, and is focusing instead on

increasing tourism from other countries.

“We’re watching this very carefully and realizing that until

flights are allowed back in the U.S., we’re looking at a no-go in terms

of the potential for visitation,” Ferguson said. “But we’re cautiously

optimistic that this is something we’ll be able to rebound from, and

we’re looking at the opportunities for us in other international markets

that continue to strengthen.”

In addition to the direct impact of decreasing visitation from

China, fears about the spread of the virus could lead to an overall drop

in travel from within the U.S. and other overseas markets.

R.W. Baird Director of Equity Research Michael Bellisario, who

analyzes hotel REITs, said he sees more of an impact related to overall

business travel than tourism from China.

“It’s still early, but the indirect impact is what’s scarier, and

business confidence,” Bellisario said. “You don’t have to have

coronavirus in the U.S., but if companies are worried about it and say

‘I don’t want my employees to travel,’ then the markets they travel to

like New York, Chicago, San Francisco, Los Angeles, Boston and

Washington, D.C., those markets are going to get hit first.”

Foxhall Partners Managing Partner Matt Wexler said a group canceled

a stay at one of his company’s D.C. hotels recently and cited the

coronavirus as the reason, even though they were not coming from China.

“There’s no doubt it could impact the D.C. hotel market and our

hotels,” Wexler said. “I’m not losing sleep over this today, but it’s

worrisome, and there’s not a whole lot we can do about it. It’s just

another one of these external threats.”

Wexler noted that in January 2019, D.C.’s hospitality industry was

impacted by the federal government shutdown, another factor out of the

control of the hotel industry. Just as with the shutdown, the

coronavirus outbreak is occurring in the first two months of the year,

which tend to be the slowest months for tourism in D.C.

“Frankly, December, January and February are not big tourist

months,” said CityPartners founder Geoffrey Griffis, whose firm owns

multiple D.C. hotels. “Our business guests are still very strong, but I

think that we should be anticipating some change in the tourism demand,

depending on how long this runs for.”

Donohoe Hospitality President Thomas Penny said he has not seen a

material impact on the performance of his company’s hotels because of

the coronavirus, but he also said it could become a larger issue if it

does not end soon.

“We’re paying attention because historically, we see an increased

number of Chinese visitors coming into the spring, summer and fall, so

we’re monitoring it closely with the hopes it will begin to subside,”

Penny said.

But even if the outbreak does end soon, hotel demand in the spring

and summer could be impacted because many Chinese tourists begin

planning their trips months in advance, Ferguson said.

“The reality is for those that make plans three to six months out,

and those that need to obtain a visa, they’re probably not going through

that process, and therefore we’re going to see a hit, and the U.S. is

going to see a hit,” Ferguson said.

No comments:

Post a Comment