The disappearance of Washington Post journalist Jamal Khashoggi after entering the Saudi Arabian consulate in Istanbul on 2 October has sparked controversy around the globe, not least regarding the financial reliance of governments and businesses on investment from the Kingdom. Because of the outcry raised by Khashoggi’s disappearance and the potential involvement of the Saudi government, several high-profile political and business figures have pulled out of an investment conference due to be held in Riyadh next week, and Richard Branson has walked away from a £1B deal for the Saudi government to invest in his Hyperloop One business. Saudi Arabia’s government and royal family have not been as significant real estate investors as their Middle Eastern peers from Qatar and Abu Dhabi. But they have been flexing their muscles recently, and own some high profile and trophy assets around the globe.

Accor Hotel Portfolio Wikipedia A Novotel Hotel — Accor owns brands including Novotel and Pullman Saudi Arabia only recently set up its own sovereign wealth fund — the Public Investment Fund — to try to reduce the country’s dependence on oil revenues. Its only international real estate deal so far is a whopper: It was among a group of investors that paid $5.4B for a 55% stake in Accor’s portfolio of 890 mainly European hotels. It is reported to have been the largest investor, buying 15% of the overall portfolio.

SoftBank Wikimedia/SoftBank Hankyu-Ibaraki PIF has been an indirect investor in some of the largest real estate and PropTech deals of the past few years. It contributed $45B to SoftBank’s $93B Vision technology fund which has backed several real estate businesses, most notably WeWork. It was recently reported that SoftBank would pay between $10B and $20B for a majority stake in WeWork. PIF has also invested in Katerra, Compass and Fortress Investment Group.

Blackstone’s Infrastructure Business Wiki Commons/Flickr Blackstone CEO Stephen Schwarzman Not quite real estate but certainly real assets — PIF said last year it would invest up to $20B in an infrastructure fund being raised by Blackstone, saying it would match every dollar raised by the firm with a dollar of its own. In April it was reported that the fund was approaching a first close of $5B. Blackstone CEO Stephen Schwarzman is one of the business figures who has pulled out of the Riyadh conference.

Chateau Louis XIV Wikimedia Commons Chateau Louis XIV near Paris — with iPhone-controlled fountains. Saudi Arabia’s de facto ruler, Crown Prince Mohammed bin Salman (known as MBS) was reported to be the buyer of what has been described as the world’s most expensive house, Chateau Louis XIV to the west of Paris, for $300M. Despite the name it is a new building on a 57-acre plot, a 17th-century-style replica, with fountains that can be controlled by iPhone.

Kingdom Holdings Flickr/Alan Light The Plaza Hotel in New York The most well-known investment firm in real estate related to the Saudi royal family is Kingdom Holdings, the company built up by Prince Alwaleed Bin Talal Bin Abdul-Aziz Alsaud of Saudi Arabia. It owns stakes in famous hotels around the world including the Plaza in New York and the Savoy in London. Alwaled is persona non-grata at home at the moment: Earlier this year he was arrested and detained by MBS as part of an anti-corruption probe seen as a way of controlling rival factions within the extended Saudi ruling elite.

Neom Wikimedia Commons Saudi Arabia wants to build a smart city in the desert. In terms of Saudi Arabia’s domestic real estate projects, the most ambitious is Neom, a smart city the country is looking to build in the desert in the north west of the country. The low key goals it has outlined for Neom include changing the entire course of human history.

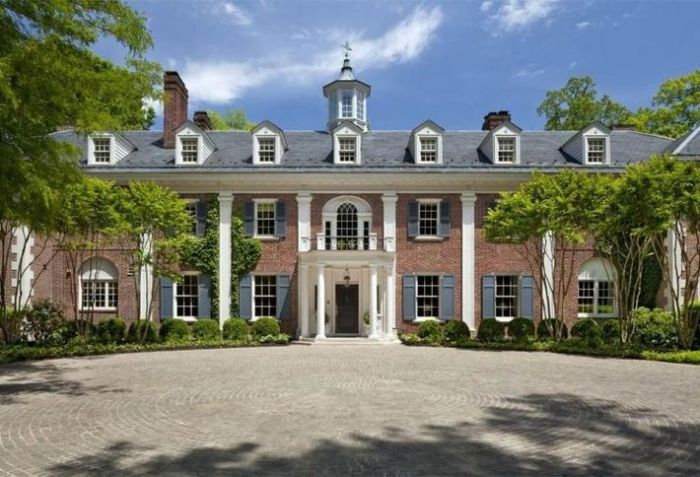

Merrywood Estate, McLean Sotheby’s International Realty/Gordon Beall The Merrywood estate in McLean The Saudi government have been more prolific investors in Europe than the U.S., but one significant American purchase was the Merrywood Estate in McLean, Virginia, which was sold by AOL co-founder Steve Case to the Embassy of the Kingdom of Saudi Arabia for $43M earlier this year, a potential record for a home sale in the D.C. area.

Fidelity Fund Investment Courtesy of Pembroke Real Estate Fidelity’s new HQ in London Fidelity Investment received a mandate earlier this year from NCB Capital to invest $150M in European real estate, which with debt would give the mandate $300M to invest in assets between $20M and $60M. NCB is Saudi Arabia’s biggest bank and is majority owned by government institutions including PIF.

No comments:

Post a Comment