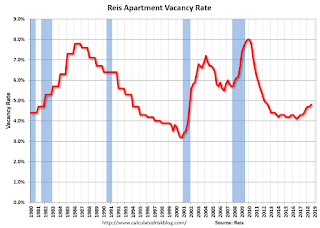

Reis reported that the apartment vacancy rate was at 4.8% in Q3 2018, up from 4.7% in Q2, and up from 4.4% in Q3 2017. This is the highest vacancy rate since Q3 2012. The vacancy rate peaked at 8.0% at the end of 2009, and bottomed at 4.1% in 2016.

From Reis:

The apartment vacancy rate increased in the quarter to 4.8% from 4.7% last quarter and 4.4% in the third quarter of 2017. The vacancy rate has now increased 70 basis points from a low of 4.1% in Q3 2016.The national average asking rent increased 1.2% in the third quarter while the average effective rent, which nets out landlord concessions, also increased 1.2%. At $1,424 per unit (market) and $1,356 per unit (effective), the average rents have increased 4.5% and 4.2%, respectively, from the third quarter of 2017.Net absorption was 35,683 units, lower than the previous quarter’s absorption of 57,988 units and below the average quarterly absorption of 2017 of 46,685 units. Construction was 50,475 units, also below the second quarter’s 67,417 units and below the 2017 quarterly average of 61,535 units.

…

The apartment market had slowed at the end of 2017 and early 2018 as the housing market started to accelerate. However, the passing of the Tax Reform and Jobs Act in December that doubled the standard deduction and cut the deductibility of state and local taxes reduced the incentive to buy a home. This has helped the apartment market, especially in high-taxed localities.We expect construction to remain robust for the rest of 2018 and in the first half of 2019 before completions drop off in subsequent periods. Occupancy is expected to remain positive, although vacancy rates are expected to increase, as new supply will outpace demand growth. Still, as long as job growth holds steady, we expect rent growth to remain positive over the next few quarters.

No comments:

Post a Comment