Consumers are facing the most severe housing affordability crisis in a generation. Tens of millions of folks have been priced out of homes in the last year, primarily due to skyrocketing borrowing costs and a shortage of housing supply that has pushed prices to mind-numbing levels.

We have documented the quick collapse of the 'American Dream' in "Housing Crisis Worsens As Affordability Reaches Record Low" and "Housing Affordability Worsens As Homeownership Out Of Reach For Anyone Making Under $100k".

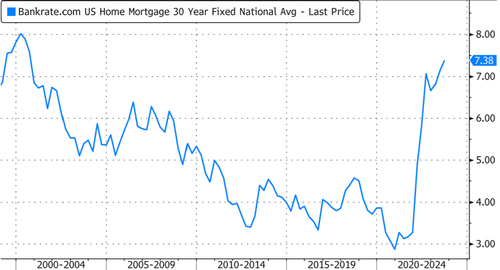

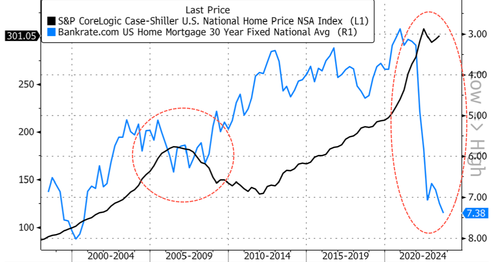

In June, the National Association of Realtors and Realtor.com published a report that found over 75% of the homes listed on the market are too expensive for the middle class. Thanks to a rapid surge in the average 30-year fixed mortgage rate from 3% to over 7% and a 40% rise in national home prices during the pandemic era.

Millions of consumers are on the sidelines, searching Zillow and other realtor websites for the perfect starter home. But what prevents many from buying a home has been high borrowing costs during two years of negative real wages. So many are wondering: When do mortgage rates fall? We may have found that answer.

Morningstar has published a new housing report that forecasts the average 30-year fixed mortgage rate is set to peak around 7% and then trend lower in the back half of the year, with an average rate for the year around 6.25%. Morningstar's forecast model shows 5% for 2024 and even 4% for 2025.

"The Fed has engineered a massive increase in interest rates in order to combat high inflation. We expect it to cut the federal-funds rate aggressively in the coming years, driving the [Federal funds] rate down from 5% currently to below 2% by 2025," economists from Morningstar wrote in the report.

"Once the Fed wins the battle against inflation, its priority will shift to jump-starting economic growth, which will require much lower interest rates, in our view," they said.

Morningstar continued, "Regardless of what happens in the next few years, we expect interest rates to ultimately settle back down at the low levels that prevailed before the pandemic. The low-interest-rate regime will resume once the dust settles from the pandemic economic volatility."

And they noted, "Our long-term interest-rate projections are driven by secular trends. Factors such as aging demographics, slowing productivity growth, and increasing inequality have acted to push down real interest rates for decades, and these forces haven't gone away."

Morningstar expects rising incomes and sliding home prices will improve housing affordability.

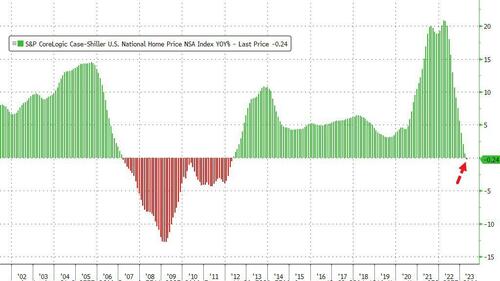

The good news for home prices is that Case-Shiller's National Home Price Index turned down in April for the first time since April 2012.

"Our revised home price forecast now projects new- and existing-home prices to decline 6% and 4% over 2022 to 2024, respectively," Morningstar said. They called a downturn in home prices or a "mild correction," noting a plunge in prices would be prevented due to inventory shortage nationwide.

We suspect sliding home prices is what the Federal Reserve is hoping for, and judging by mortgage rates, prices have a long way to fall...

Hard landing probabilities continue to rise as the Fed is hellbent on tightening financial conditions to tame inflation. This increases the prospect of the Fed continuing to break the economy, just like what happened in regional banks earlier this year, which would then cause them to pivot. So the best thing a prospective homebuyer could hope for is a recession that would ultimately lower borrowing costs as the Fed would have to switch from QT to stimulative measures.

No comments:

Post a Comment