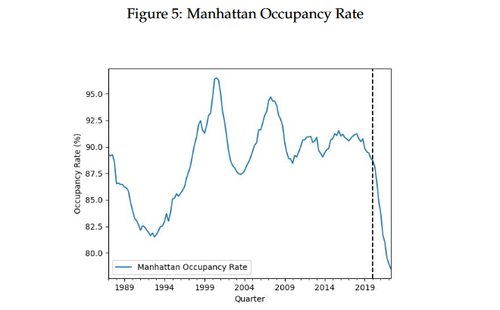

Leading up to the Covid-19 pandemic, roughly 95% of commercial office space was occupied across the United States, according to US National Bureau of Economic Research (NBER) – a nonprofit, non-government organization. By March 2020, occupancy plummeted to 10%, and has only recovered to 47%, according to a new NBER report which claims $453 billion in office commercial real estate value has been wiped out in an "office real estate apocalypse."

Around the US, that resulted in a 17.5 percent decrease in lease revenue between January 2020, and May 2022, and not only because fewer offices were being occupied, but also because those that are being rented are going for shorter terms, lower prices per month, and a lot less floor space is needed as staff are told they can work from home for most or all the week.

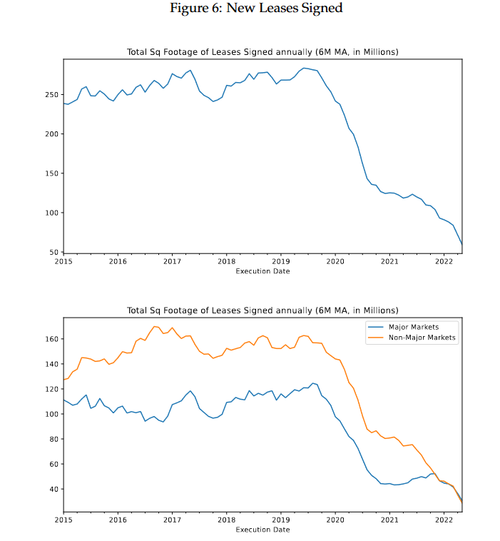

Prior to the pandemic, 253 million square feet were rented per year; as of May 2022, just 59 million square feet had been rented, NBER's data indicates. "This indicates a massive drop in office demand from tenants who are actively making space decisions," NBER said. -The Register

What's more, while vacancy rates have hit a 30-year high, 61.7% of in-force commercial leases haven't come up for renewal since the pandemic - meaning that "rents may not have bottomed out yet."

What this means is that commercial real estate - a popular choice for pension fund managers and investors alike - may not be the best idea for the foreseeable future, given the continuing work-from-home options adopted by corporate America.

A common method used to invest in office real estate is commercial mortgage-backed securities (CMBS), which are managed and traded via commercial mortgage-backed indexes (CMBX) made up of pools of CMBSes.

According to NBER, more recent CMBXes tend to include a higher percentage of office collateral than earlier vintages. Those newer, office-heavy CMBXes, NBER said, are what's losing the most money. -The Register

NBER says that in 2019, commercial real estate assets topped $4.7 trillion - offices being the largest component.

Read the report below:

No comments:

Post a Comment