Oil prices were lower on the day on reports that the US is planning additional releases of Strategic Petroleum Reserve crude in response to OPEC+ cuts and OPEC+ defending its cuts due to teh growing risk of a global recession..

"Transferring SPR crude oil from emergency reserves to commercial tanks now would likely not help in lowering retail gasoline prices, or do so only marginally," Brian Milne, product manager, editor, and analyst at DTN, told MarketWatch.

"Such a policy does not make sense."

And for now we will keep an eye on inventory levels for signs of demand problems.

API

Crude -1.26mm

Cushing +890k

Gasoline -2.17mm

Distillates -1.09mm

After last week's huge crude build, API reported a very small crude draw this week (and products also saw drawdowns)...

Source: Bloomberg

WTI was hovering around $82.50 ahead of the API data and drifted very modestly higher after the small crude draw...

Shortly after the close, CNBC reported that 'sources' confirmed President Biden will announce yet more releases from the SPR tomorrow.

Bloomberg reported that the Biden administration is moving toward a release of at least another 10 million to 15 million barrels of oil from the SPR.

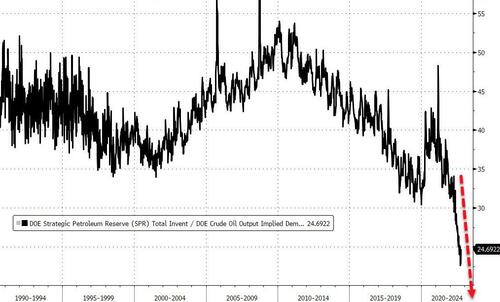

That will take the SPR to even more record-er lows in terms of supply.

The bigger drivers lowering U.S. gasoline prices, however, were "sharply lower demand from China amid its zero-COVID policy that has stymied economic activity, and reduced transportation demand as millions of citizens were either locked down or had other restrictions reduce their mobility," DTN's Milne said.

"Domestically, climbing inflation, including high gasoline prices, has led consumers to reduce their driving."

The problem is "not a lack of crude oil but a lack of refining capacity," said Milne.

"U.S. policy pushing away from oil consumption has led to refinery transitions to renewables, or outright closures. This trend accelerated during the COVID-19 pandemic."

But none of that matters as this supports the propaganda that Biden is doing 'something' into the midterms...

No comments:

Post a Comment