While mortgage rates are soaring and mortgage applications plunging, the data from the highly-lagged 'Case-Shiller' index shows home prices (in February) rose significantly more than expected (up 2.39% MoM vs +1.5% exp).

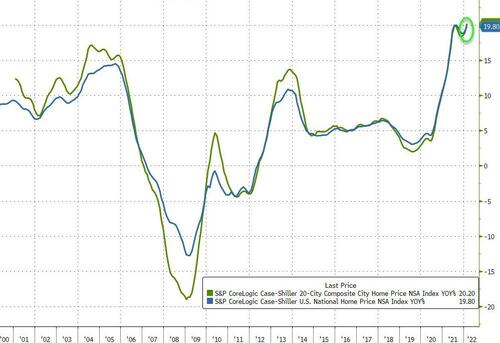

This sent the 20-City Composite home price index to a 20.2% YoY gain - the fastest pace on record!

The national price index also rose at a record 19.80% YoY.

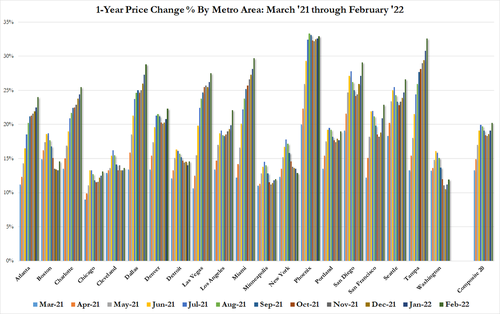

Phoenix, Tampa, Miami reported highest year-over-year gains among 20 cities surveyed

"The macroeconomic environment is evolving rapidly and may not support extraordinary home price growth for much longer," Craig J. Lazzara, managing director at S&P Dow Jones Indices, said in statement.

But Lazarra does recognize the pain to come:

"The post-COVID resumption of general economic activity has stoked inflation, and the Federal Reserve has begun to increase interest rates in response. We may soon begin to see the impact of increasing mortgage rates on home prices."

And he is right to worry since this data is so old now that it is almost obsolete in the face of the dramatic shift in the interest rate (and monetary policy) environment. Is home-price growth about to turn negative for the first time since 2010?

No comments:

Post a Comment