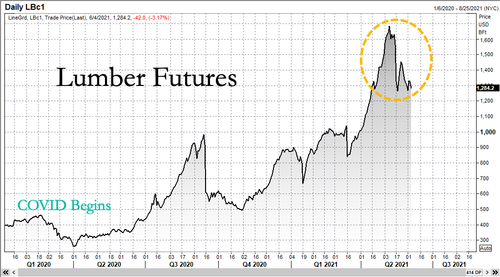

Lumber futures on Chicago Mercantile Exchange fell -3.1% to $1,284.20 per 1,000 board feet, extending last week's first loss since January. For the last 18 trading sessions, lumber prices have come under pressure amid signs that an unprecedented rally may be waning.

Citing data from trade publication Random Lengths, CIBC analyst Hamir Patel told Bloomberg that Western spruce-pine-fir prices decreased $130, or -8.1%, compared to last week's $1,470 per 1,000 board feet, and Southern yellow pine 2x4 lumber dropped $92, or -6.9%, to $1,236 per 1,000 board feet.

The decline comes alongside a drop in lumber futures, which have tumbled into a bear market, -25%, in recent weeks, from an all-time high reached earlier in May of around $1,711 per 1,000 board feet.

This suggests that sawmills could be catching up amid the flurry of demand from North American homebuilders, along with supply chain issues, which created massive supply constraints, which propelled lumber prices to record highs.

"Record softwood lumber prices amid an acute supply shortage appear unsustainable and may correct sharply from a level that's quadruple the 10-year average," Bloomberg analyst Joshua Zaret wrote this week.

But with lumber prices adding tens of thousands of dollars to new residential builds, some builders have paused or halted new construction.

Rep. Bob Gibbs, R-Ohio, who serves on the House Oversight Committee's environment subcommittee, told FOX Business that increasing lumber prices are "just one of the many indicators that President Biden is failing American workers."

"Lumber prices are an issue that has many causes, from economic complications from the coronavirus pandemic to difficult trade issues with Canada. Biden has shown he is either unwilling or incapable of tackling these obstacles," Gibbs told FOX Business.

Last week, Patel told Bloomberg that even though home renovations are easing, lumber prices could maintain around the $1,000 handle through 2021.

Despite the latest pullback, prices are likely to remain elevated until the Federal Reserve begins or at least signals that it will start to taper its $40 billion per month in mortgage-backed securities purchases.

https://www.zerohedge.com/commodities/lumber-prices-slump-historic-boom-may-be-easing

No comments:

Post a Comment