The construction industry can seem as unshakable as the steel frames that hold office towers together and the concrete poured into foundations of new homes. But last year has shown that even the mundane changes that Americans saw in their own lives because of the pandemic -- shopping more from Amazon (AMZN) - Get Report, getting milk and bread delivered to their front doors, and working and schooling over Zoom (ZM) - Get Report – is leading to major shifts in the building industry.

That's a key takeaway from a report out late last week from Oxford Economics that details what happened to the construction industry during 2020 and what to expect during a boom in many types of building over the coming years.

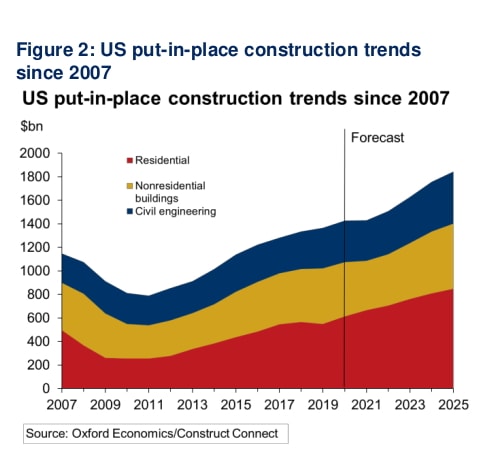

Despite the COVID lock downs, Zoom classrooms, and empty malls and offices, the construction industry saw little pain during the pandemic over 2020, concluded Oxford. In fact, the industry as a whole enjoyed robust growth, as total put-in-place spending surpassed $1.4 trillion nationally. That’s 4.7% higher than construction spending in 2019, according to Oxford.

"It was one of the few sectors that really didn't see a dip in activity,” said the report's author and economist Jeremy Leonard, who’s based in London, in phone interview with TheStreet. “That's a sharp contrast to here in the U.K. where construction sites closed and there was a big dip.”

But Leonard said the full picture of both the past year – and the strong overall growth forecast in the years ahead – is complicated and nuanced.

Pandemic Sets Foundation for Change

During 2020, the construction industry saw uneven growth by subsector and location, thanks largely to COVID and technology put in place that allowed people to avoid leaving their homes for work, school and shopping.

Cities and states with strict lock-down rules like New York had gave the industry a tough time. So did, to some extent, places with looser regulations but a high dependency on travel and tourism, like Florida. But other locations, like Texas were booming. In fact, the Lone Star State held the largest construction market at $196 billion in 2020, thanks to a growth in manufacturing, power generation, and transportation.

At the same time, residential building, which jumped 11% last year, was the main driver of growth nationwide, especially in the latter two quarters, according to Oxford. Spending on offices and recreation and amusement facilities, however, took a hit.

Mixed Year Ahead

"Looking further out, it does get interesting," said Leonard. "Just because we saw growth last year, doesn't necessarily mean that we're going to see lower growth for the medium-term."

Next year, said Leonard, the industry will see several surprising shifts play out: Residential will continue to grow, while commercial construction stagnates and in some sectors declines. Office construction spending is expected to get whopped the hardest. That segment is forecast to decline through next year and by 2025 it will come out virtually unchanged from 2020, even though the economy should be 10% or 15% larger, said Leonard. Airport construction will be hurt, as well.

But lodging, which was pummeled by the pandemic, will see a stronger recovery beginning in 2022, and infrastructure building is forecast to grow 4.7% on average over the the next five years -- a hotter pace than in the past decade. President Joe Biden's plans for "clean" power will likely spur further investment in “green” projects like new charging stations, and retrofitting and building green field power plants, said Leonard.

Construction Gets a Lot of Clicks

Despite an expected dip in office building, commercial construction will get a boost from the place Americans spend a vast amount of their shopping dollar: online.

While office projects are tabled because builders are buying into the notion that employers are going to let people work from home more, big new warehouses are going up to meet online shopping demand.

“There's going to be less need for retail stores, shopping malls and those kinds of things,” said Leonard. “At the same time, the warehouse segment of the construction business is expected to do quite well. If more people are buying from Amazon, that means more warehouses, more distribution centers. In fact, it's quite interesting, because if you look most of the megaprojects that we've seen, in the last year, there were many fewer than there had been in previous years. The vast majority of them and warehousing and distribution centers.”

That's backed up by other surveys and data. The pandemic has “permanently reshaped eCommerce,” according to a separate report out this month by Adobe Analytics. That report found that over the 12 months from March 2020 to February 2021, the U.S. saw a total of $844 billion spent online. That's a more than a 42% growth over calendar year 2019, reports Adobe. Based on current trends, Adobe says it expects 2021 to pull in between $850 billion and $930 billion in online shopping, and next year is expected to be the “first trillion-dollar year" for eCommerce.

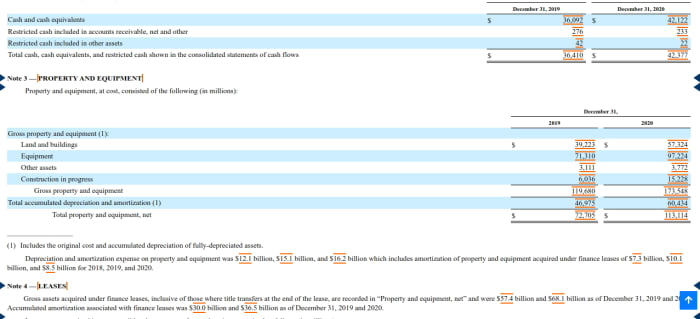

Amazon, meanwhile, is likely to build scores of new warehouse “fulfillment centers” across the U.S., spending billions in construction on works in progress this year, according to the company's financial reports, data from logistics firm MWPVL International and CNBC.

The catch, however, is that amount of construction needed to build warehouses is less and different than what’s needed to build shopping malls, retail stores and offices, Leonard said. In the end, the shift to eCommerce will show up as a net negative for the commercial building as a whole.

“It's going to have a big impact on a lot of different suppliers – the construction supply chains,” he said.

Warehouses won’t lead to the kind of spending in carpets, tiles, wall papers and paints, plumbing fixtures and windows that’s seen when building office towers, shops and malls.

“I would say those who will be most impacted in this commercial sector will be those further down the supply chain, the ones who are doing the fixtures in retail establishments and putting in the interiors in the office buildings.”

Home Is Where the Building Is

Housing will see similar changes fueled by the pandemic and technology, although with higher growth. The potential ability to be employed by a company in one city and work remotely in a different place means more people may be moving into new homes in different parts of the country – likely towns that are cheaper.

"If we look out further, it really has to do with the housing side and where we are in the very long cycle. If we look at the numbers for housing starts, compared to what is needed for the formation of new households, it was very much below that for much of the 2010s,” he said.

Homebuilders like KB Home (KBH) - Get Report and Toll Bros. (TOL) - Get Report have already said they're seeing a boost. KB said earlier this year that net orders for its most recently reported quarter grew 42% to 3,937, the company’s highest fourth-quarter level since 2005 -- after seeing some pandemic-related pain last year. Toll Bros., meanwhile, has said its quarter ended Jan. 31 got a boost in profit and saw home sales revenue up 9% compared to fiscal 2020’s first quarter.

Catch up in residential is still needed, Leonard said, because of population growth from immigration and because of demographic changes.

“We're seeing this big shift of millennials who stereotypically moved into studio apartments in cities and now are starting to get married and want to move out to the suburbs, just like their parents and grandparents did. They want to have nice grassy lawns, places to play and maybe better schools. So, we're seeing a big demand in single family homes for that kind of structural reason."

Because the millennial generation is relatively large, that portion of the population alone is likely to lead to much of the forecast growth in residential building. Single-family housing is predicted to grow the most.

"Millennials might not like to admit it," said Leonard, "but they behave just like generations that came before them. After they've had their fun being single and enjoying the benefits of urban life, they settle down and they do want more space and they do want more security.”

https://www.thestreet.com/investing/covid-forged-big-changes-in-the-construction-industry

No comments:

Post a Comment