The coronavirus pandemic has left no part of the travel industry

unscathed, and that includes the unicorn of the short-term rental world.

Airbnb, like traditional hotels, has been hit hard by a flood of

cancellations, lost revenue and plummeting daily rates, but the company

has also had to contend with headwinds unique to the short-term rental

sector.

A number of cities around the country already have stringent

regulations against short-term rentals, and the spread of COVID-19 has

only made that more the case. Some cities across the U.S. like Portland,

Maine, and Ocean City, New Jersey, have banned short-term rentals in

efforts to contain the coronavirus.

Meanwhile, the collapse in occupancies, which are more closely

tracked in traditional hotels but have affected short-term rentals much

the same, is unprecedented. In the week ending March 28, U.S. hotels saw

revenue per available room, or RevPAR, drop 80.3%, according to data

released by STR Wednesday.

On Airbnb’s marketplace, how the company initially handled the

demand drop-off left many of its hosts out of luck. After extending

refunds to guests with reservations between March 14 and April 14, the

San Francisco-based company drew the ire of a number of disaffected

rental owners upset about being uncompensated for the lost income. It

has since established a $250M fund for hosts impacted by cancellations,

of which there have been many.

For the beginning of April, the cancellation rate for Airbnb stays

has reached nearly 90%, but not without some silver lining, according to

Scott Shatford, founder of AirDNA, a short-term rental data and

analytics company.

“It’s a pretty staggering number, and that’s one story to tell,”

Shatford said. “But we’re seeing a lot of long-term, 30-plus-day rentals

as people’s calendars have cleared out.”

Many hosts have looked to take advantage of an impulse for

“quarantine tourism,” as Shatford puts it. Hospitality company D.

Alexander, for instance, launched on Wednesday “Destination Isolation,” a

new line of 30- to 90-day stays to tap into the new kind of demand.

(Shatford himself serves as an adviser to D. Alexander Capital,

according to his LinkedIn profile.)

With that as some recourse for cash-strapped hosts, the level of

supply active on Airbnb’s marketplace remains largely unchanged,

according to AirDNA. Even so, 30-day bookings are being offered at

around 60% discounts, compared to the 20% seen in normal circumstances,

as hosts look for new ways to lock in revenues, according to Shatford.

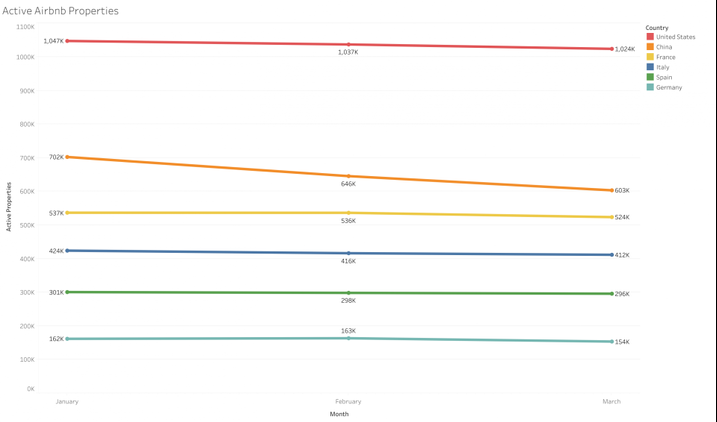

Market Volatility Leads Short-Term Rentals Into Uncharted Territory

Courtesy of AirDNA

Active Airbnb properties so far in 2020.

For Airbnb, along with its direct short-term rental company

competitors, it remains to be seen how well it can weather a

several-month stretch of decimated revenue figures.

“Future prospects are extraordinarily uncertain,” LW Hospitality

Advisors principal and Chief Operating Officer Evan Weiss said. “Hotel

business will return; we’ve been through downturns before.”

From hotels own issues with slowing average daily rate, or ADR,

growth before COVID-19 and looming CMBS troubles now, the traditional

hotel industry isn’t without its own issues, though Weiss points to a

number of questions Airbnb and other short-term rental companies will

have to address whenever travel picks up again.

Some, like with hotels, predate the coronavirus pandemic, like

Airbnb’s sudden inability to post a profit in 2019 after being a bright

spot among billion-dollar tech startups in that regard. Others questions

might arise out of new consumer demands and concerns stemming from the

pandemic, like unknowns around cleaning standards.

“People will only travel if they feel safe,” STR Senior Vice President of Lodging Insights Jan Freitag said.

“If you’re a brand property, you have a lot of marketing dollars

and standard operating procedures behind you, and you have a way to

communicate those SOPs to guests.” Short-term rentals “might have a

little bit of a tougher go,” said Morningstar’s Dan Wasiolek, a senior

equity analyst who follows publicly traded online travel companies like

Booking Holdings and Expedia Group, both of which post to Airbnb its

biggest competition in the short-term rental sector.

“People that depend on [short-term rentals] for income are going to

continue to want to depend on that,” he said. “But there might be a

slower rebound going into an individual’s home versus a large Marriott

hotel.”

Regarding Airbnb’s cleaning standards, a spokesperson for the

company pointed to guidelines it has established with its new initiative

for hosting coronavirus responders. The company did not respond to

requests for comment on how much revenue Airbnb lost in March, nor on

the company’s plans to go public this year.

Those plans, which the company revealed in September, are in

jeopardy, according to D.A. Davidson Cos. Senior Vice President and

Senior Research Analyst Tom White.

Airbnb, which is reportedly considering raising more money from

private investors, shouldn’t necessarily fare any worse than traditional

lodging companies through the ongoing pandemic, White said. But how it

plans for a public offering should only add to the intrigue.

“When a company goes public, investors focus on what kind of story

the last year or two of financial results told about a company,” he

said. “In Airbnb’s case, the timing of this demand shock is really bad.”

No comments:

Post a Comment