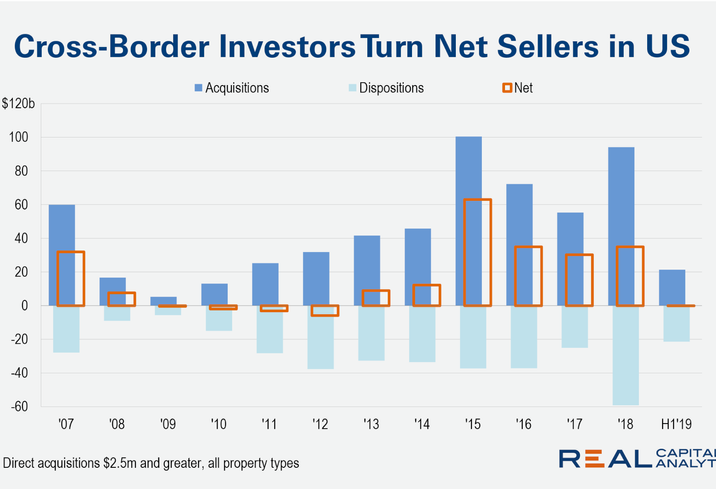

For the first time since 2012, more foreign capital is flowing out of U.S. real estate this year than into it. In the first half of 2019, foreign investors purchased $21.3B worth of real estate and sold $21.4B worth, according to a new report by Real Capital Analytics.

Although China’s pullback has led much of the discussion surrounding cross-border investment, RCA found that the change has been driven not by one region punting entirely on the U.S., but by every region investing moderately less.

The driving force behind the drop has been a lack of available deals large enough for sovereign wealth funds and their ilk, the study said. The percentage of cross-border investment that has gone to portfolio or corporate acquisitions has plummeted compared to single-asset transactions.

In the past four quarters, 42% of all foreign investment was spent in entity-level deals, but the number drops to 14% when the timeline is restricted to Q2, according to RCA.

Canadian Brookfield Asset Management remains a dominant force among foreign investors into the U.S. In the past four quarters, Brookfield has spent over six times as much on U.S. real estate as the second-most-active capital source, German-based Allianz, according to RCA data. Yet Canadian investment dropped the most of any region in the world in the first half of the year.

Courtesy of Real Capital Analytics

Investment from the Middle East this year has already matched the region’s U.S. spending from all of last year, led by Kuwaiti sovereign wealth investment vehicle Wafra. The firm has spent over $1B on just two deals, underscoring how influential large transactions are on the overarching numbers.

Manhattan remains far and away the most likely market for cross-border real estate investment (though Boston is reportedly starting to catch up), but the type of investments that have been made there this year are telling for the world’s current outlook. In the most recent four quarters, foreign money has been behind 53% of all construction starts in the borough, but not one cent of that has occurred in the first half of 2019.

Though recession fears have risen in recent weeks, especially with regard to foreign markets, RCA characterizes the current trend in cross-border investment as a “yellow warning sign rather than a red one” due to the investor class’ dependence on huge deals.

No comments:

Post a Comment