Newly empowered New York Democrats eyeing rent control laws set to expire on June 15 pose a risk to loan growth and credit, Wedbush warned in a note. That helped push shares of New York Community Bancorp and other exposed banks lower in trading Wednesday.

Republicans had controlled the state’s Senate for the past decade, and had successfully blocked Democratic efforts to change rent regulation laws, analyst Peter Winter wrote in a note. Now, Democrats are in complete control of New York state government and have “introduced nine bills on rent regulation that clearly favor the tenants,” he said.

That means there’s “potential risk brewing to the multi-family lending business in New York.” The risk comes, he said, not from “a credit perspective, as these loans are conservatively underwritten,” but rather from “potentially weaker loan demand and less refi activity.” That would hurt prepayment income, which in turn would hurt net interest margin, Winter wrote.

Wedbush downgraded Signature Bank to neutral from outperform and listed the top five banks with exposure to New York City multi-family lending, in order: NYCB, Dime Community Bancshares, Signature Bank, Investors Bancorp and Sterling Bancorp.

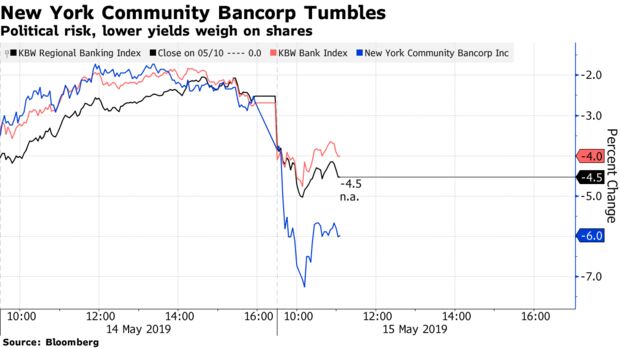

NYCB slid as much as 4.9% to the lowest intraday since January 18, and was one of the worst performers in the KBW Bank Index. Signature Bank sank as much as 5.9%, to the lowest since January 17; Dime Community fell as much as 2.5%, Investors Bancorp as much as 2.4%, and Sterling as much as 2%.

Lower yields were likely also weighing on interest-rate-sensitive regional banks, which underperformed larger banks.

The KBW regional bank index fell as much as 2.7% to the lowest since April 1, led by Signature Bank, versus a 2.2% drop for the broader KBW bank index, which was dragged down not only by NYCB, but also by SVB Financial Group, KeyCorp and Comerica Inc.

Earlier, Treasuries added to an early advance after weaker-than-expected April retail sales data included notably soft core readings, while the yield on two-year notes fell to the lowest level in more than a year, as investors sought safety amid global economic, trade and geopolitical worries.

On May 10, American Banker wrote that New York property owners and the banks that lend to them were opposing housing advocates and Democratic lawmakers seeking more protections for rent-controlled apartment tenants.

No comments:

Post a Comment