by John Haughey via The Epoch Times,

Masons laid the concrete foundation from “bare dirt” in 39 days and laborers were ready to frame and roof the skeletal superstructure so carpenters, plumbers, and electricians could complete the single-family home.

All that remained was approval of an “interior remodel,” a slight variation from the permit issued months earlier by the Kansas City Planning and Development Department’s Permits Division.

But it was April 2024, and things had changed.

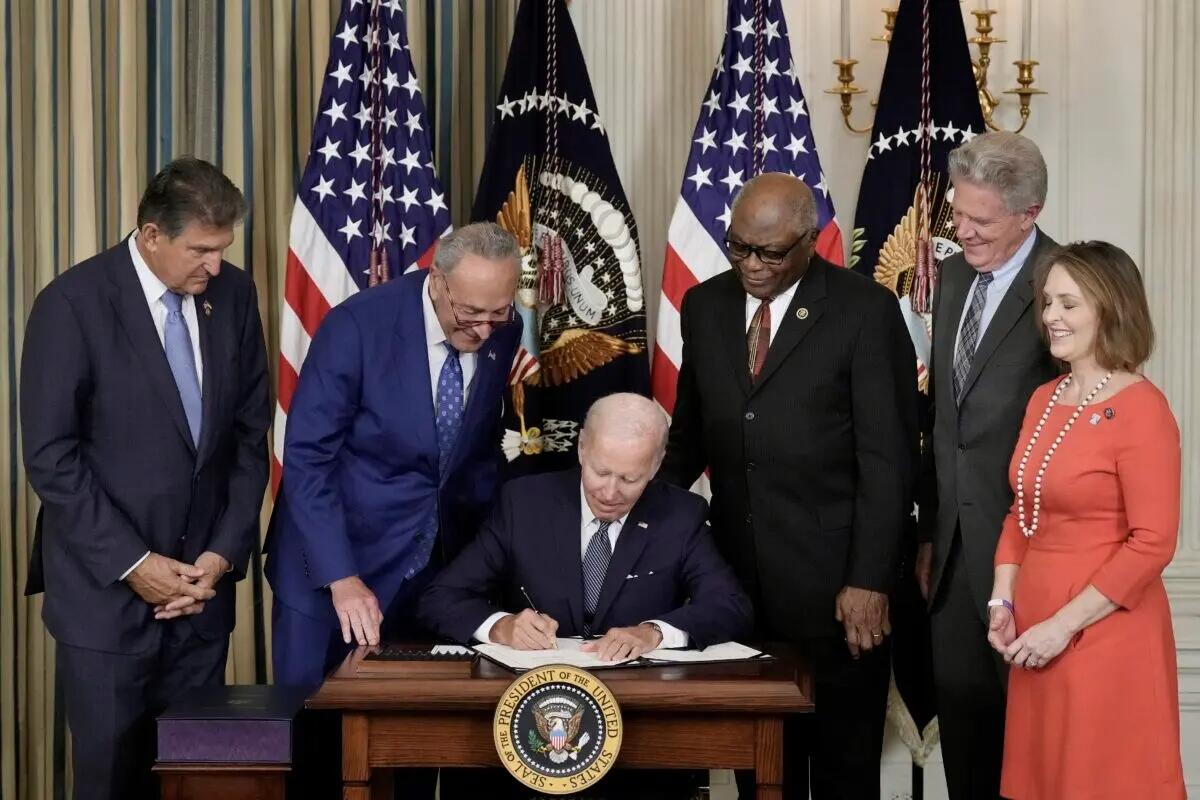

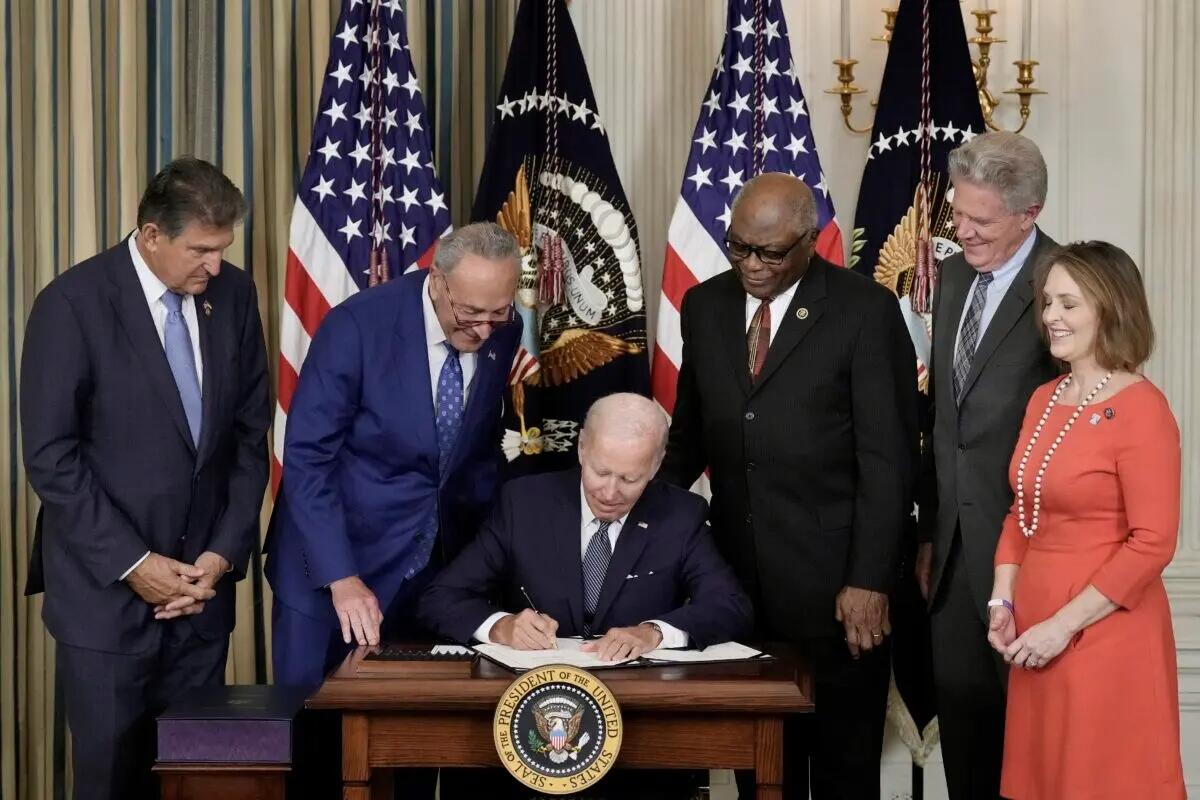

The previous summer, the City Council adopted the 2021 International Energy Conservation Code (IECC), in part because doing so made Kansas City eligible for grants under a $1 billion program authorized by 2022’s Inflation Reduction Act (IRA).

The standards went into effect on Oct. 1, 2023, meaning modifications from the original permit would now be evaluated under new IECC guidelines.

“Traditionally, a permit like this—covering a nonstructural basement finish—takes only a few days to process,” Patriot Homes President and owner Brian Tebbenkamp told a House panel on Tuesday. “Instead, it took 39 days.”

Tebbenkamp, speaking on behalf of the Home Builders Association of Greater Kansas City, was one of four witnesses to appear before the House Energy Subcommittee during a Sept. 16 hearing on eight proposed bills addressing building and appliance codes.

"During that time, the house sat with a completed foundation while our framing crew sat at home with no work,” he testified. “Our crews built that foundation from bare dirt in 39 days. Ultimately, it took a lengthy appeal to the mayor, the full City Council, and the city manager before the permit was finally approved—on the 39th day.”

The Home Builders Association of Greater Kansas City and the National Home Builders Association are among trade groups calling on Congress to adopt HR 4758, the Homeowner Energy Freedom Act, which would repeal the IRA’s “high efficiency electric home” rebates and defund its grant program for state and local governments that adopt the unamended 2021 IECC.

“This program has distorted local processes, driven up costs, and discouraged investment in housing production—all while doing little to improve real-world energy performance,” Tebbenkamp said. “I urge Congress to move quickly on this legislation to restore balance and ensure housing policies support affordability rather than undermine it.”

Construction workers build a home in Hercules, Calif., on July 1, 2025. Justin Sullivan/Getty Images

Code Without Covenant

The Homeowner Energy Freedom Act, sponsored by Rep. Craig Goldman (R-Texas), was among six building code measures discussed during the five-hour hearing, which included Department of Energy (DOE) Acting General Counsel Jeff Novak providing testimony for more than three hours, followed by a 90-minute panel discussion sandwiched around a 45-minute pause for a House floor vote.

The other building code-related proposals include HR 3699, to prohibit state and local governments from banning natural gas; HR 5184, to eliminate “duplicative” energy standards for manufactured homes; HR 3474 and HR 4690, to terminate the “phase-out of fossil fuels” and repeal energy performance standards in federal buildings; and HR 1355, to reauthorize DOE’s weatherization program.

American Gas Association Vice President for Governmental Affairs George Lowe, in his testimony, also espoused support for the Homeowner Energy Freedom Act, as did Association of Home Appliance Manufacturers Vice President Jennifer Cleary in her testimony.

Tebbenkamp explained how “well-intentioned federal policies” adopted inside the Washington Beltway can have “very real and negative effects” on Main Street USA.

Residential and commercial buildings must comply with federal, state, and local laws and regulations implemented through building codes, performance standards, and fuel-use efficiency requirements generally developed from consensus input by the Washington-based International Code Council and the American Society of Heating, Refrigeration, and Air-Conditioning Engineers, headquartered outside Atlanta.

The code council in 2021 updated its energy standards—the IECC—to include what many builders saw as model codes favoring electric furnaces and water heaters over those fired by natural gas or coal.

Under the Biden administration, especially after the IRA’s adoption, the federal role in what is traditionally the purview of state regulators and local planners expanded dramatically in pushing “net-zero” emissions requirements.

Tebbenkamp said “model building codes in federal legislation and regulatory programs is not new” and, while they may influence standards adopted by state and local governments, they’re rarely encoded without amendments.

The difference was IRA’s grant stipulation that eligibility required unamended adoption of the 2021 IECC, he said, calling the demand to “treat stricter codes as the universal solution ... deeply concerning.”

President Joe Biden signs the Inflation Reduction Act as Democratic lawmakers look on at the White House on Aug. 16, 2022. Drew Angerer/Getty Images

Costly Lure

In April 2022, Kansas City introduced an ordinance to adopt the 2021 IECC, Tebbenkamp told the subcommittee, noting after months of “meetings, forums, and hearings to determine whether the model code was suitable for our community,” it appeared “consensus was forming that some localized amendments would be necessary.”

Then, in August 2022, Congress passed the IRA in a partisan vote hailed by Democrats as key to the nation’s transition from fossil fuels to clean energy. Its Section 50131 created the $1 billion grant fund for state and local governments to adopt the 2021 IECC “as written,” he said.

“From that moment on, supporters resisted all amendments—worried that even minor modifications might forfeit access to the grant program,” Tebbenkamp said.

The new code was adopted in summer 2023. Before it went into effect that October, 98 Kansas City companies pulled single-family home permits, he said. “By 2024, that number had fallen to just 22—a 78 percent reduction in builders willing or able to operate under the new code.”

Since the IRA’s adoption, a Home Builders Association of Kansas City study and National Home Builders Association analysis estimate that the additional regulations can add $31,000 to the price of a new home.

Tebbenkamp said his Patriot Homes uses the Home Energy Rating System (HERS) Index “to ensure our homes perform at a high level” of energy efficiency.

The home his crews were building in April 2024 would save “$2,548 a year in utilities compared to an average home,” he said. “But to comply with the 2021 IECC prescriptive path, our clients had to spend an additional $10,300. The payoff? A ... saving [of] just $2 a year in additional operating costs.”

Let builders build, state regulators regulate, and local planners plan, Tebbenkamp said, without mandating adherence to “one-size-fits-all” codes.

“The lure of federal funding effectively shut down what had been a collaborative and constructive local process,” he said. “To our knowledge, Kansas City has not received a single dollar from the Department of Energy for adopting the code, yet the impact on local housing production has been severe.”

https://www.zerohedge.com/political/builders-say-deconstructing-green-building-codes-will-lower-new-housing-costs

Fannie Mae reported that the Single-Family serious delinquency rate in August was 0.53%, unchanged from 0.53% in July. The serious delinquency rate is up year-over-year from 0.50% in August 2024, however, this is below the pre-pandemic lows of 0.65%.

Fannie Mae reported that the Single-Family serious delinquency rate in August was 0.53%, unchanged from 0.53% in July. The serious delinquency rate is up year-over-year from 0.50% in August 2024, however, this is below the pre-pandemic lows of 0.65%.