Chinese billionaires have lost massive wealth due to the property market downturn and turmoil in the world's second-largest economy. In response, Beijing has rolled out yet another stimulus package, this time on Tuesday, as the Communist Party of China seeks to appear more proactive in supporting the economy amid a decades-long, investment-driven growth model that has hit stumbling blocks over the last several years.

The multi-year economic downturn has roiled the billionaire class in China, with many losing their billionaire status and being downgraded to centi-millionaire.

Financial Times cites new data from research group Hurun, which shows the number of dollar billionaires plunged by over one-third in the last three years. The destruction of the billionaire class has been met with a barrage of stimulus measures to address underlying structural problems (debt, fertility crisis, deflation, property market woes, ect...), crushing the economy into a slow growth regime.

Hurun data shows that at the 2021 peak, there were 1,185 dollar billionaires in China. By the second half of 2024, that number plunged to 753, or about a 36% plunge, surpassing a 10% drop in the renminbi's value against the dollar over the same period. This year alone, the number of dollar billionaires in China tumbled 16%, when the renminbi only depreciated by 2.5% against the dollar.

China's decades-long investment-led growth boom in the property market minted billionaires upon billionaires. However, the downturn has wiped out many entrepreneurs with huge fortunes tied to property developer firms.

Rupert Hoogewerf, chair of the Hurun Report, commented on the billionaire list, indicating it "has shrunk for an unprecedented third year running, as China's economy and stock markets had a difficult year."

Topping the list is ByteDance founder Zhang Yiming. He surged to the top, beating out "bottled water king" Zhong Shanshan, with a net worth of $49.3 billion.

The Hurun report said that newly minted billionaires represent a "new generation of entrepreneurs in China that is much more international than their predecessors."

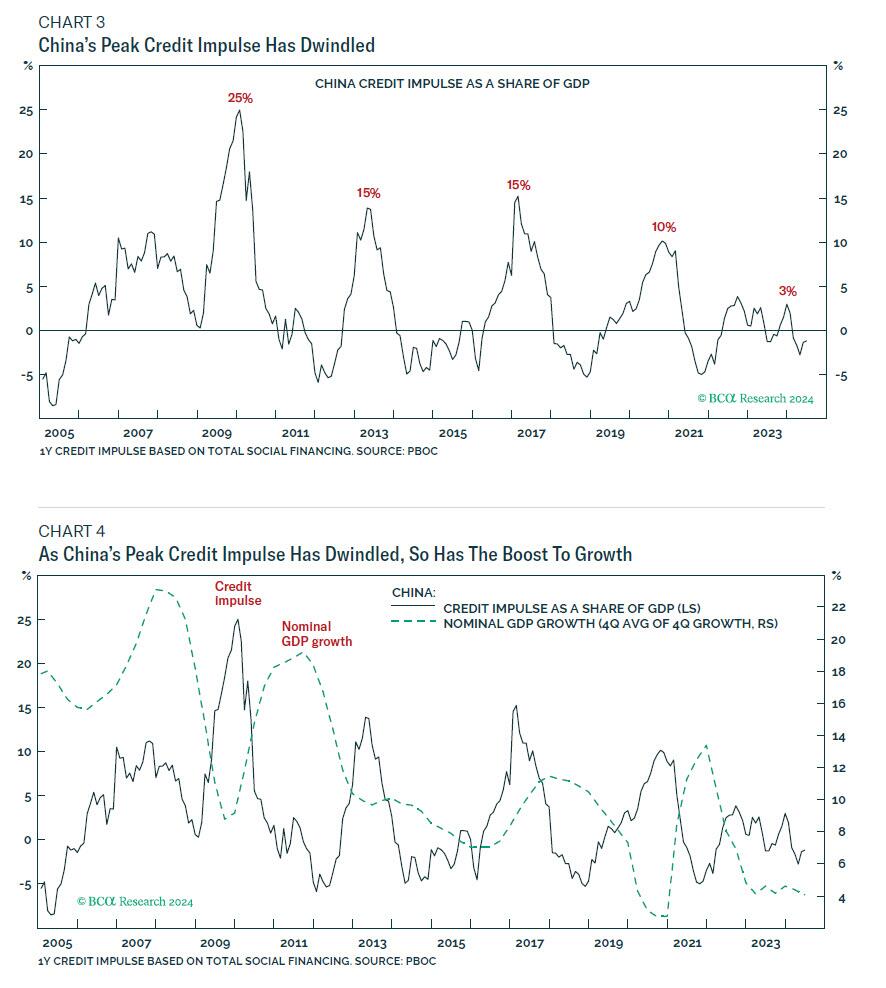

As we explained early Tuesday following the announcement of yet another Chinese stimulus package, the 10 trillion yuan package may be insufficient to kickstart the economy ... and explained in "Why China's Rally Won't Have Legs" ... is that China's peak credit impulse - the all-important reflationary variable that propagates across the global economy - has dwindled, and so has the boost to growth.

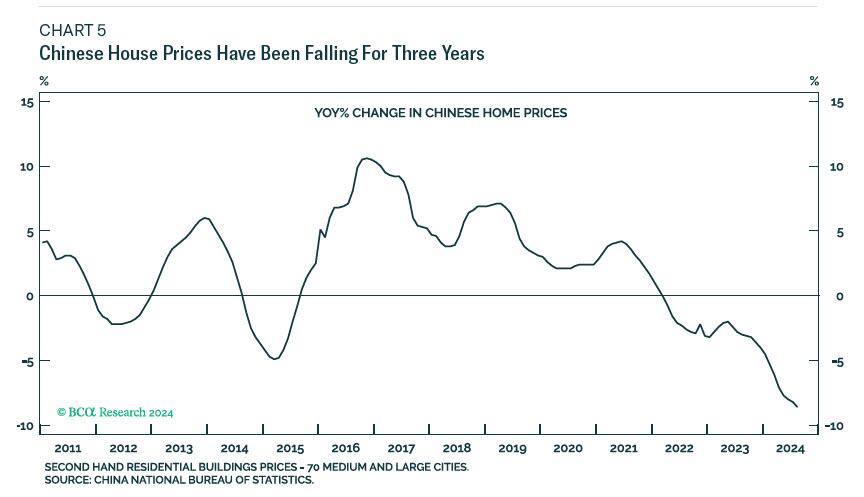

In other words, to achieve the same stimulus level as a % of GDP, China would need to inject tens of trillions more. And since it can't do that, at least not without its middle class kicking and screaming (literally), China's house price will continue to slide, having recently tumbled by a record YoY amount...

What does this mean for the Chinese billionaires tied to the housing market? Well, the pain train will continue until Beijing unleashes a real stimulus bazooka.