Billionaire Barry Sternlicht, Founder, Chairman and CEO of Starwood Capital Group has issued an ominous warning about America's regional banks, which he says will fail at a rate of 'one or two' per week.

Speaking with CNBC on Tuesday, Sternlicht says he thinks that primary real estate lenders - community and regional banks - are about to get whacked.

"You're going to see a regional bank fail every day, or not — every week, maybe two a week," he said, adding that Fed Chair Jerome Powell's ongoing rate hikes will continue to have consequences for the real estate sector.

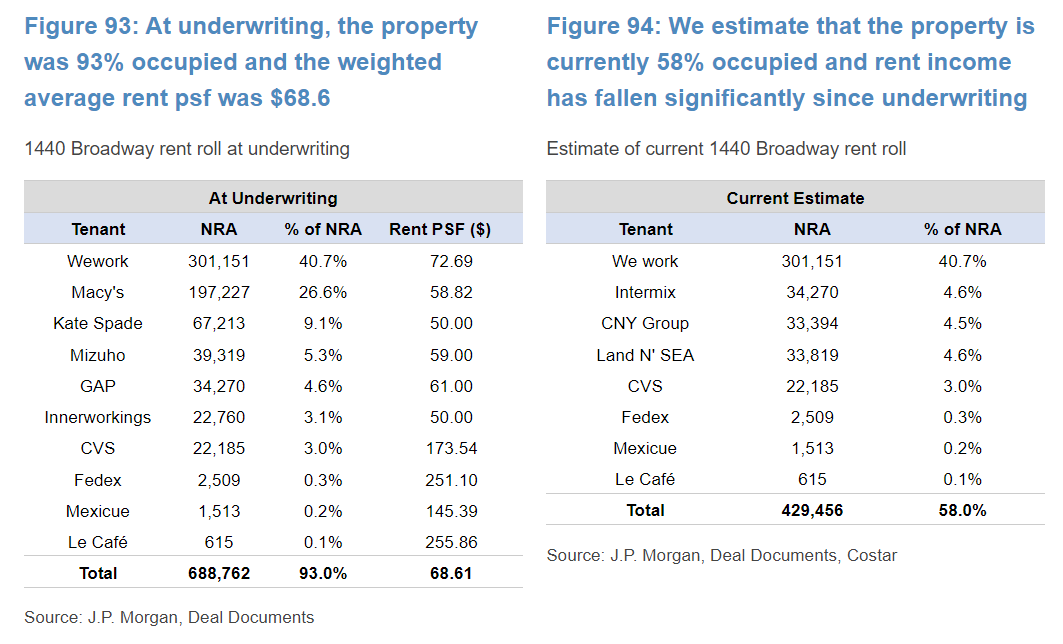

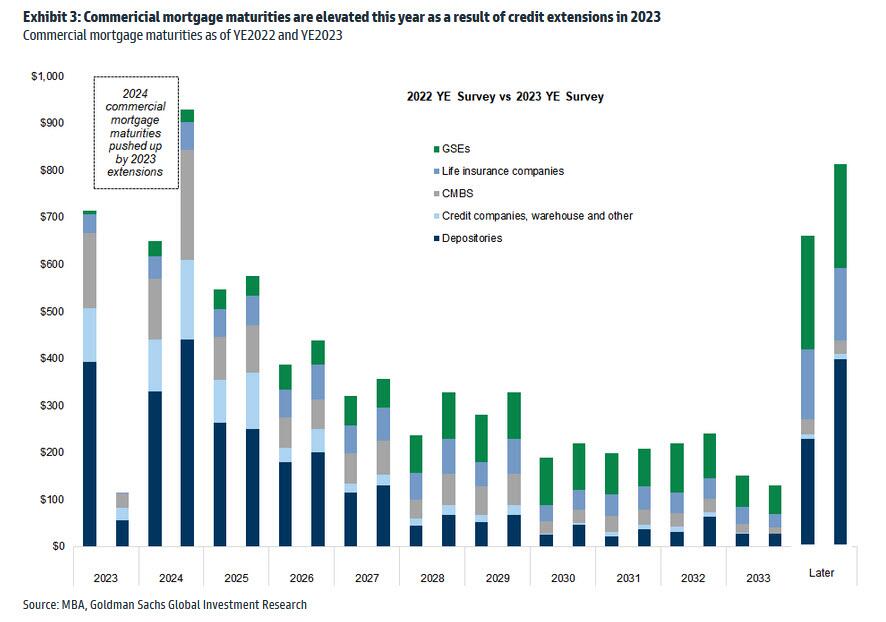

"He's got a hard task with a blunt tool, and the consequence is the real estate markets are taking it on the chin because rates rose so fast. We could have handled this, but we couldn't handle it this fast," he said. "The 1.9 trillion of real estate loans, that's a fragile animal right now."

Watch:

As Schiff Gold notes, the fed must cut to avoid a banking crisis.

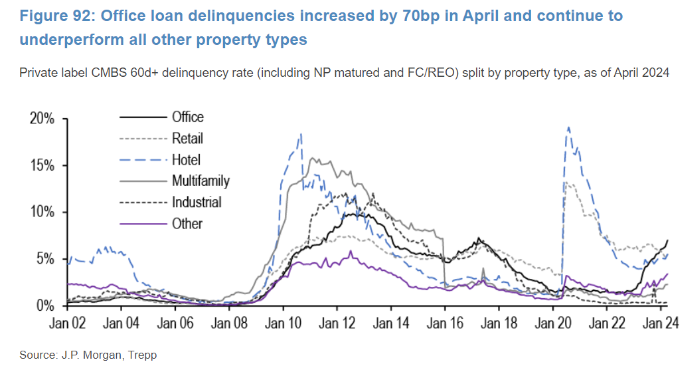

Most at-risk firms are smaller banks representing assets under $10 billion, with a handful of larger regional ones. Some might be able to avoid closing by halting expansion plans or offering fewer services. Others might save themselves by merging with larger banks. But with inflation too high for the Fed to cut now, “higher for longer” interest rate policy is looking increasingly likely, and banks with high exposure to troubled commercial real estate are at particular risk of starting a domino effect of small collapses that lead to bigger ones and bleed into becoming a real estate crisis.

...

In all its hubris, the Fed is stuck between preventing a banking crisis and preventing inflation from getting even more out of control. It needs higher rates to reduce inflation, but crucial sectors of the economy that are heavily dependent on lending can’t survive in a higher-rate environment, even if they don’t appear insolvent at first glance.

There are more than 4,000 regional and community banks throughout the United States, however just one - Republic First Bank - has shuttered since the start of 2024, after the FDIC seized $4 billion in deposits and $6 billion in assets last month.

Read more here, here, here, and most detailed here.

Meanwhile, UK fund manager, former MEP, and previously Nigel Farage's economic spokesman Godfrey Bloom has issued a similar warning to Stenlicht, telling former UK parliamentary candidate Jim Ferguson on his podcast that the banks are insolvent.

"We are entering a new dark age," says Bloom, who recommends that people "take your money out of the banks."

Watch: